Toronto to Miami has never been more relevant as Canadian investors explore cross-border opportunities, the comparison between real estate returns . With housing market shifts, currency fluctuations, and evolving tax structures, understanding real estate ROI (Return on Investment) in both cities is crucial for informed investment decisions. This blog offers a detailed, unbiased, and purely informational comparison to help Canadians make data-driven choices.

Overview of the Toronto Real Estate Market (2025)

Market Trends and Prices

Toronto remains Canada’s financial and cultural hub. As of mid-2025, the average price of a detached home is around CAD $1.4 million, with condos averaging CAD $720,000. Price growth has slowed due to higher interest rates and stricter mortgage rules. However, population growth and limited housing supply continue to support long-term price appreciation.

Rental Yields in Toronto

Average gross rental yields in Toronto hover around 3% to 4% for condos, slightly higher in suburbs. Rent control and tenant protection laws may limit profitability but offer long-term stability. Vacancy rates in the downtown core have slightly increased post-pandemic, though rental demand remains solid in key transit-oriented developments.

Tax Considerations in Toronto

- Capital gains on secondary property are 50% taxable.

- Property taxes range from 0.61% to 1.2% depending on location.

- Ontario Non-Resident Speculation Tax (NRST) applies a 25% tax on foreign buyers (though exemptions exist for permanent residents).

- Land Transfer Tax (including Municipal LTT in Toronto) adds a significant cost to initial investments.

Overview of the Miami Real Estate Market (2025)

Market Trends and Prices

Miami has rebounded post-pandemic with strong migration and foreign investment. As of 2025:

- Median single-family home price: USD $625,000

- Condo average: USD $430,000

- High demand in areas like Brickell, Wynwood, and Coconut Grove

- Inventory is tightening as more remote workers from northern states and Canada relocate south

Rental Yields in Miami

Rental yields in Miami average between 5% to 7%, with short-term rental markets (Airbnb) potentially offering up to 10% ROI, especially in tourist-heavy areas like South Beach. However, HOA restrictions and municipal regulations may limit short-term rentals in some zones.

Tax Considerations in Miami Florida

- No state income tax, which is appealing to Canadian investors

- Property taxes are about 1% to 1.5% of assessed value

- FIRPTA applies: 15% withholding for foreign sellers, refundable upon U.S. tax filing

- Income from U.S. property must be declared in Canada, although tax credits reduce the impact of double taxation

Currency Exchange and Investment Impact

Canadian Dollar vs. U.S. Dollar

Fluctuations between CAD and USD play a crucial role in cross-border ROI. In 2025, the CAD trades around 0.74 to 0.78 USD, meaning:

- A $500,000 USD property costs approximately CAD $645,000

- Rental income in USD converts to more CAD when the CAD is weaker, enhancing ROI

Banking and Financing Challenges

- Canadian banks typically do not finance U.S. properties directly

- Cross-border financing options include RBC Bank USA and TD Bank USA

- Miami-based lenders may require 30% to 40% down payment for foreign nationals

- Toronto financing is more straightforward but subject to stricter stress tests and CMHC rules for investment properties

Toronto to Miami Key Differences for Real Estate ROI

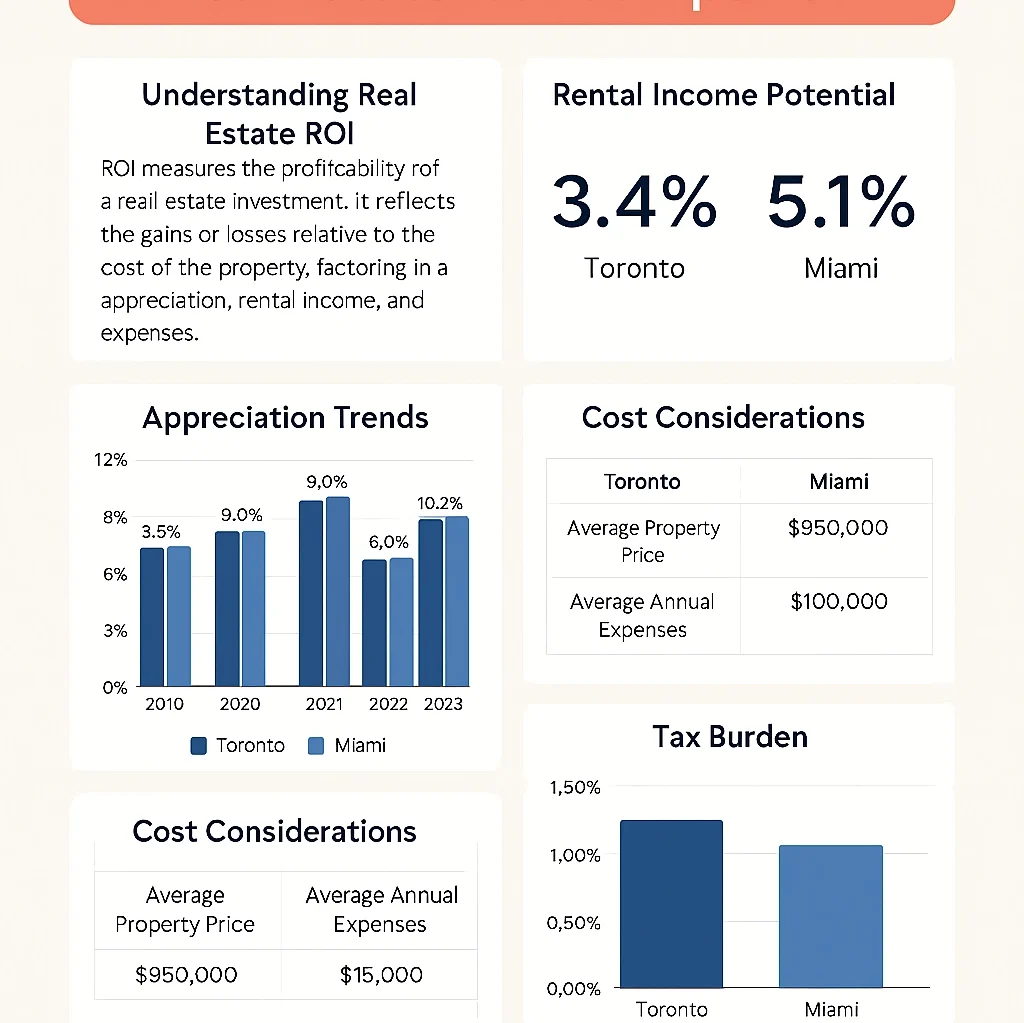

Appreciation Trends

Over the last five years (2020-2025), both cities have experienced notable appreciation, but Miami has outpaced Toronto due to migration trends and tax benefits.

Appreciation Comparison Chart (2020-2025)

| Year | Toronto Avg. Appreciation | Miami Avg. Appreciation |

|---|---|---|

| 2020 | 6% | 4% |

| 2021 | 7% | 9% |

| 2022 | 5% | 10% |

| 2023 | 3% | 6% |

| 2024 | 4% | 8% |

| 2025 | 5% (projected) | 9% (projected) |

Miami has benefited from tax migration and tech/finance sector relocations, while Toronto’s price growth has stabilized after sharp gains during 2020–2021. Miami’s pro-business environment and weather have driven higher speculative and lifestyle-driven investment, which contributes to above-average appreciation.

Toronto to Miami Rental Income Potential

Here’s how gross rental yield compares for similar condo investments.

Rental Yield Comparison Table

| City | Avg Property Price | Avg Monthly Rent | Gross Yield (%) |

| Toronto | CAD $720,000 | CAD $2,400 | 4% |

| Miami | USD $430,000 | USD $2,800 | 7.8% |

Miami offers better rental yield due to higher rent-to-price ratio and favorable short-term rental economics. Toronto’s lower rental yields are offset by lower volatility and stronger regulatory protection for landlords and tenants.

Tax Burden

Tax Burden Comparison Table

| Tax Category | Toronto, Canada (CAD) | Miami, USA (USD) |

| Property Tax | 0.61% to 1.2% | 1% to 1.5% |

| State Income Tax | None | None |

| Capital Gains Tax | 50% of gain taxable | FIRPTA: 15% withheld |

| Speculation Tax | 25% NRST for foreign buyers | None |

| Withholding on Sale | None | FIRPTA applies for Canadians |

While Toronto has predictable tax structures, Miami benefits from Florida’s lack of state income tax and absence of speculation tax. FIRPTA withholding adds complexity for Canadians selling U.S. property, but refunds can be obtained with proper tax filings.

Who Should Invest Where? Toronto to Miami

Best Fit for Conservative Investors

Toronto is ideal for:

- Canadians who prefer domestic regulation

- Investors seeking stable long-term gains

- Lower volatility and stronger tenant protection

- Simplified tax filing and currency predictability

Best Fit for Aggressive Growth

Miami is ideal for:

- High-risk, high-return investors

- Short-term rental operators (Airbnb, vacation homes)

- Investors seeking tax-efficient wealth growth

- Those comfortable with cross-border complexity and currency fluctuations

Legal and Visa Considerations

Owning U.S. Property as a Canadian

- No visa required to own property in Florida

- B1/B2 visa allows up to 6-month stays

- LLCs can be used for privacy and estate planning

Title and Legal Services

- Title insurance is strongly recommended

- Hire a U.S. real estate attorney familiar with Canadian investor issues

- Cross-border estate planning helps avoid probate complications

Hidden Costs to Consider

Toronto

- Land transfer tax (double in Toronto city limits)

- High legal fees and closing costs

- Tenant turnover costs and vacancy considerations

Miami

- HOA fees can range from $300 to $1,200/month

- Home insurance is higher due to hurricanes

- Currency conversion and cross-border tax prep

- Potential legal fees for FIRPTA compliance

Final ROI Analysis

Sample Investment: $600,000 Budget

| Feature | Toronto (CAD) | Miami (USD) |

| Purchase Price | $600,000 | $600,000 |

| Rental Income (Annual) | $21,000 | $36,000 |

| Appreciation (5 Years) | $150,000 | $225,000 |

| Net ROI (Est.) | ~5% annually | ~8% annually |

Miami outperforms Toronto in short-to-mid term ROI with stronger rental income and appreciation. However, Canadian investors must weigh additional legal, tax, and currency risks. Toronto, while offering lower returns, provides greater predictability and ease of management.

Key Takeaways

- Toronto to Miami investors should assess both rental yield and appreciation potential.

- Toronto offers stability and ease of management for Canadians.

- Miami provides higher returns and tax efficiency but requires more hands-on management.

- Currency differences and cross-border regulations from Toronto to Miami heavily influence ROI.

FAQs: Toronto to Miami Real Estate Comparison

Is it legal for a Canadian to own Miami property?

Yes, there are no restrictions. You can buy as an individual or through an LLC.

How does ROI differ when renting out Toronto vs. Miami property?

Miami offers higher rental yields (5-7%) vs. Toronto’s (3-4%) but may have more operational costs.

Are there tax treaties between Canada and the U.S.?

Yes. The Canada-U.S. Tax Treaty helps prevent double taxation, but professional advice is recommended.

Which city is better from Toronto to Miami for short-term rentals?

Miami, due to its year-round tourism and favorable short-term rental laws.

Can I get a mortgage in Miami as a Canadian?

Yes, but expect a larger down payment and higher interest rates from U.S. lenders.

Final Thoughts on Toronto to Miami Real Estate ROI

Whether you’re a conservative investor favoring the stable growth of Toronto or a risk-taker eyeing the dynamic returns of Miami, both markets present unique advantages. Toronto shines in long-term predictability and regulatory clarity, while Miami boasts higher yields and tax efficiencies attractive to international buyers. By aligning your goals, financial strategy, and tolerance for cross-border complexity, you can make informed investment choices that perform well over time from Toronto to Miami. Ready to make your next move? Explore our featured Miami listings or book a personalized consultation to get expert guidance tailored to your goals.