Last updated: January 20, 2026

Corporate Transparency Act BOI reporting changed in 2025. If you are a Canadian investor buying or operating Florida real estate through a corporation, partnership, or other entity, this update affects whether you must file Beneficial Ownership Information (BOI) with the U.S. Financial Crimes Enforcement Network (FinCEN).

This guide explains the current scope of Corporate Transparency Act BOI reporting, the foreign-entity situations most relevant to Canadians, the filing workflow, and the ongoing update requirements. For broader cross-border planning, use Miami real estate for Canadian investors, browse South Florida locations, and review our services for acquisition, compliance, and operations.

Regulatory framework

The Corporate Transparency Act (CTA) established a federal beneficial ownership disclosure program administered by FinCEN. Corporate Transparency Act BOI reporting is designed to identify individuals who own or control certain entities. BOI reporting does not change property title records and does not replace tax filings, lender disclosures, or bank due diligence.

Canadian investors typically coordinate three parallel workstreams:

- Transaction execution through real estate services and local market guidance on the blog.

- Tax and reporting through accounting services, including sale planning under FIRPTA tax strategies.

- Entity and compliance through legal services, including Corporate Transparency Act BOI reporting when it applies.

Corporate Transparency Act BOI reporting requirements

Corporate Transparency Act BOI reporting applies to “reporting companies” as defined by FinCEN. A reporting company must submit information about the company and its beneficial owners using the FinCEN e-filing portal. Whether an entity is a reporting company depends on the current definition, the jurisdiction of formation, and the entity’s registration status.

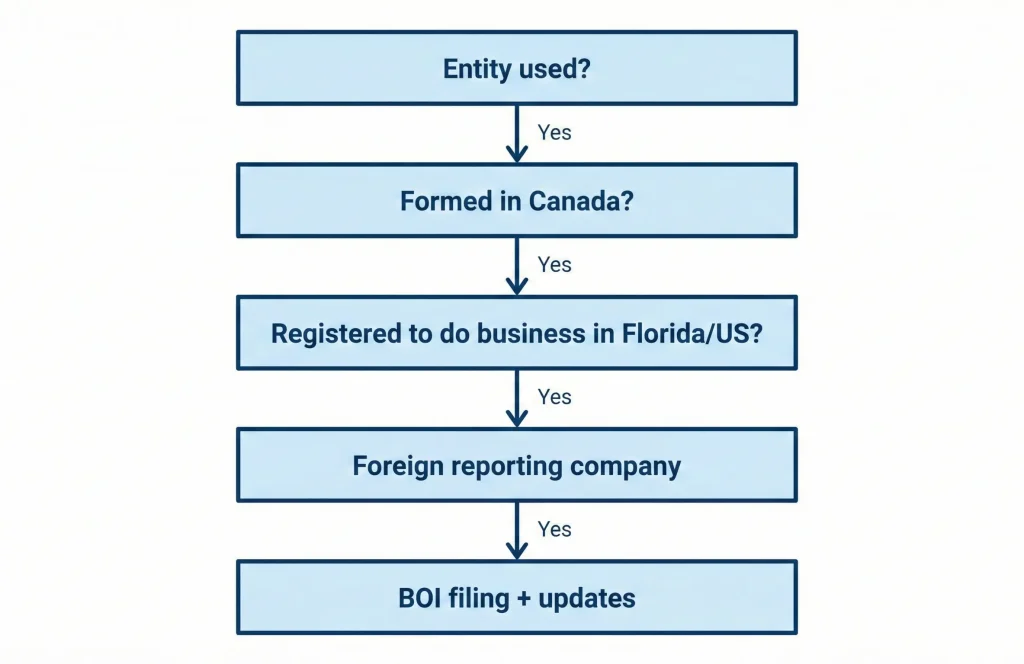

For Canadians investing in Florida, the most practical takeaway is a scope shift: under the narrowed rule, the focus is primarily on foreign entities that register to do business in the United States.

Interim final rule 2025

The 2025 interim final rule narrowed Corporate Transparency Act BOI reporting so that entities created in the United States are generally excluded from BOI reporting. The remaining reporting population is mainly foreign entities that register to do business in a U.S. state or tribal jurisdiction and do not qualify for an exemption.

If you previously planned to file for a U.S.-formed entity, verify whether the entity is still in scope under the current rule before spending time on data collection. If you are operating through a Canadian entity, prioritize the foreign-entity analysis described below.

Foreign reporting company definition

Corporate Transparency Act BOI reporting can apply to an entity formed under the law of a foreign country that registers to do business in the United States by filing a document with a secretary of state or similar office. In Florida, this registration activity is commonly completed through the Florida Division of Corporations (Sunbiz).

This is a registration-based trigger. Buying a Florida property does not automatically create a reporting company. However, a Canadian corporation or partnership can become a reporting company if it completes foreign qualification to support leasing, contracting, staffing, or other ongoing business activity.

Canadian investor scenarios

Direct personal ownership

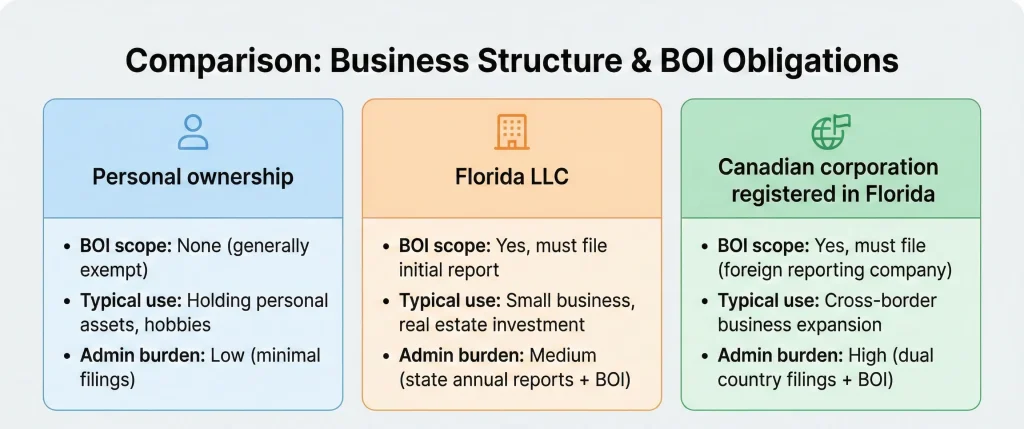

Direct personal ownership generally does not trigger Corporate Transparency Act BOI reporting because it does not create an entity. Personal ownership can still have tax and estate implications. For purchase planning and common steps, use Canadians buying homes in the U.S. and Florida real estate for Canadians.

U.S. entity ownership

Many Canadians use a Florida LLC to hold title and manage liability. Under the narrowed rule, a U.S.-formed entity is generally outside Corporate Transparency Act BOI reporting. U.S. entity ownership still requires operational planning for rentals and maintenance through property management and property maintenance.

Canadian entity ownership with Florida registration

This is where Canadian investors are most likely to be affected. If a Canadian corporation, partnership, or similar entity is registered to do business in Florida, Corporate Transparency Act BOI reporting may apply and may require an initial filing plus update filings when information changes.

Common fact patterns include:

- Renovation and contracting activity coordinated through construction services.

- Expanded rental operations where advisers recommend registration to support contracts and operations.

- Multi-investor structures registered for operational convenience.

Ownership structure table

The table below summarizes common structures used by Canadians and the typical outcome under the current rule. The BOI outcome is one factor among many (tax, liability, financing, and operations). Consider integrated planning using legal services and accounting services.

| Ownership approach | Typical BOI reporting status | Operational notes |

|---|---|---|

| Florida LLC formed in the United States | Generally outside scope under the narrowed definition | Common for liability segregation and property operations |

| Canadian corporation registered to do business in Florida | Often in scope as a foreign reporting company | Registration timing drives deadlines |

| Canadian partnership or LP registered in Florida | Often in scope if registration trigger is met | Beneficial owner mapping can be more complex |

| Direct personal ownership | No BOI reporting based on personal ownership alone | Tax and estate planning still required |

Beneficial owner identification

Corporate Transparency Act BOI reporting requires identification of beneficial owners. In general terms, beneficial owners are individuals who own or control the entity above applicable thresholds and individuals who exercise substantial control. The detailed analysis depends on governance documents, ownership layers, and control rights.

Complexity increases with:

- Multiple owners with different voting and economic rights

- Indirect ownership through holding companies

- Trust or estate planning arrangements

- Manager-managed structures where control rights are separated from economic ownership

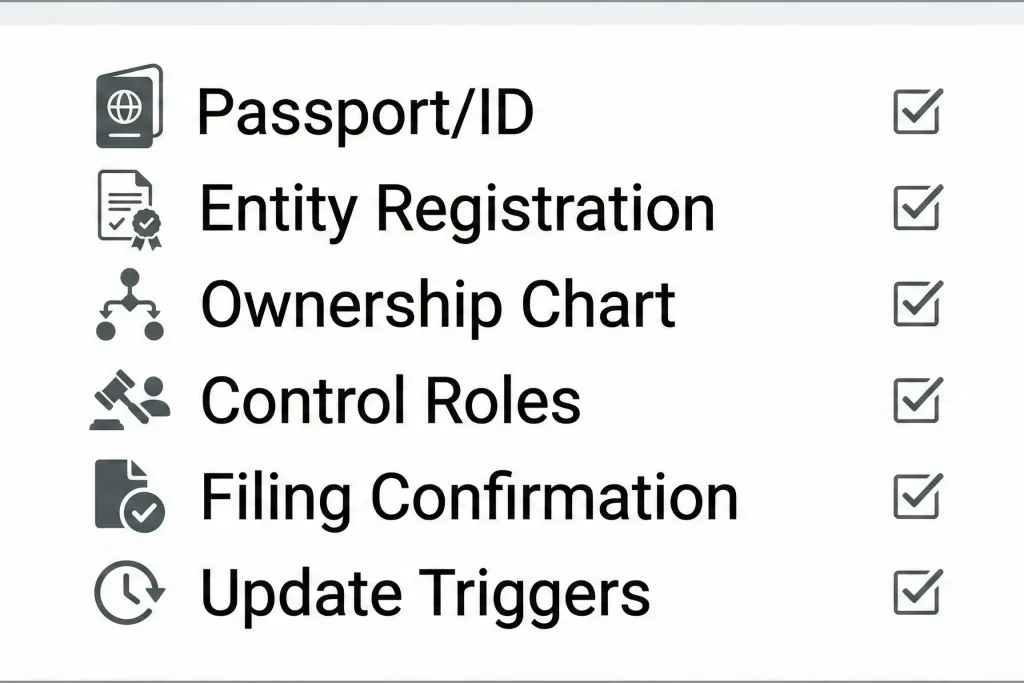

Documentation and data handling

Corporate Transparency Act BOI reporting is easiest when documentation is collected once, stored securely, and reused for updates. If you manage your investment remotely, treat BOI documentation as part of your standard investor file alongside loan documents, insurance, and operating records.

| Category | Typical items | Practical handling |

|---|---|---|

| Entity profile | Legal name, business address, jurisdiction of formation, Florida registration details | Maintain one master record used for banking and tax coordination |

| Beneficial owner profile | Name, date of birth, address, identification details, image of ID | Use a secure collection method and restrict access |

| Ownership and control mapping | Ownership schedule, operating or partnership agreement, resolutions | Confirm consistency across legal, accounting, and banking records |

BOI documentation often overlaps with financing preparation. For financing steps and document expectations, see U.S. mortgage for Canadians in Florida. For investors evaluating new builds and longer timelines, see Miami pre-construction condos for Canadian investors.

Deadlines and updates

Corporate Transparency Act BOI reporting deadlines for foreign reporting companies depend on when registration to do business becomes effective. After the initial filing, updates are typically required when reported information changes.

| Event | Typical action | Examples |

|---|---|---|

| Florida registration completed for a Canadian entity | Initial filing | Foreign qualification to sign leases or contracts |

| Change in beneficial ownership | Update filing | New investor, ownership transfer, equity issuance |

| Change in control rights | Update filing | New manager, amended governance documents |

| Change in identification information | Update filing | New passport number, new residential address |

Sale planning should integrate tax strategy and transaction planning. For sale planning and withholding considerations, use FIRPTA tax strategies.

Operational controls

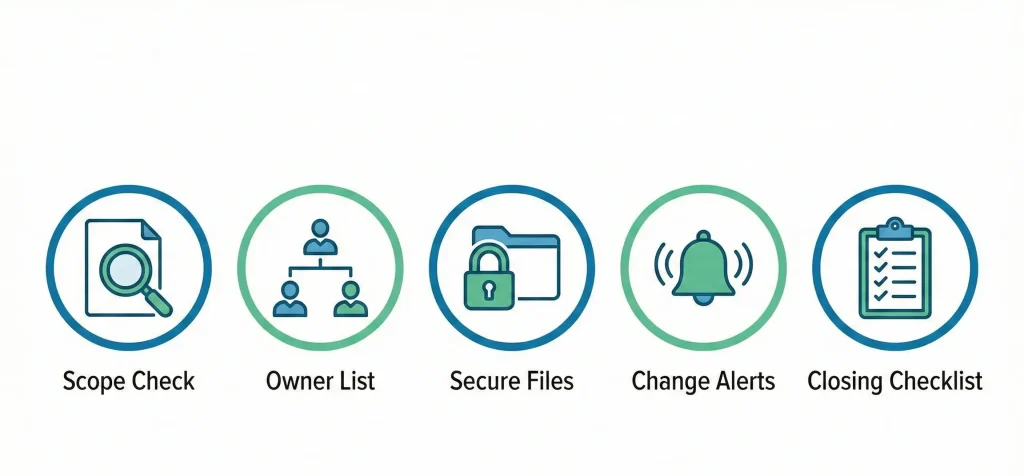

A simple control framework can reduce Corporate Transparency Act BOI reporting risk:

- Scope confirmation before registration decisions through legal services.

- Ownership mapping maintained in one place and shared with your accountant through accounting services.

- Secure document collection for identity documentation and recordkeeping.

- Update triggers documented in an internal policy.

- Transaction checklist integration for new purchases, refinances, and restructurings.

Remote ownership is easier when operations are centralized. Many Canadians combine property management, property maintenance, and construction services to keep administration and documentation consistent across service providers.

Common investor questions

Personal ownership

Personal ownership generally does not require a BOI filing because there is no entity. Most BOI filing questions arise when a Canadian investor uses an entity and the entity registers to do business.

Florida LLC ownership

Under the narrowed scope, a U.S.-formed entity is generally outside scope. If your ownership plan includes a Canadian parent entity or an out-of-country partnership, confirm whether any foreign registration changes the analysis.

Canadian corporation ownership

A Canadian corporation can become in scope if it registers to do business in Florida or another U.S. jurisdiction. The registration timing can drive the filing deadline.

Rental operations

Rental activity does not always require registration. Registration decisions depend on facts and state law. Seek legal advice before registering because registration can create compliance obligations and may affect banking and contracting.

Ongoing filings

BOI reporting is typically event-driven. Updates are needed when reported information changes, such as ownership changes or identification changes.

Bank documentation

BOI reporting does not replace bank KYC requirements. Banks can still request beneficial owner certification and supporting documents.

Sale planning

BOI reporting is not a tax filing and does not replace FIRPTA processes at sale. Use FIRPTA tax strategies for sale planning.

Official resources

- FinCEN BOI program information

- FinCEN BOI filing portal

- FinCEN BOI FAQs

- Florida Division of Corporations

Professional support

Corporate Transparency Act BOI reporting is simplest when entity scope is confirmed early, ownership mapping is maintained, and update triggers are documented. For a coordinated approach to ownership structure, compliance, and operations, use Contact us.

General information statement

This article is general information and is not legal or tax advice. Requirements depend on entity type, registration status, ownership, control rights, and exemptions. Confirm your obligations with qualified U.S. legal and tax advisers using your specific facts.