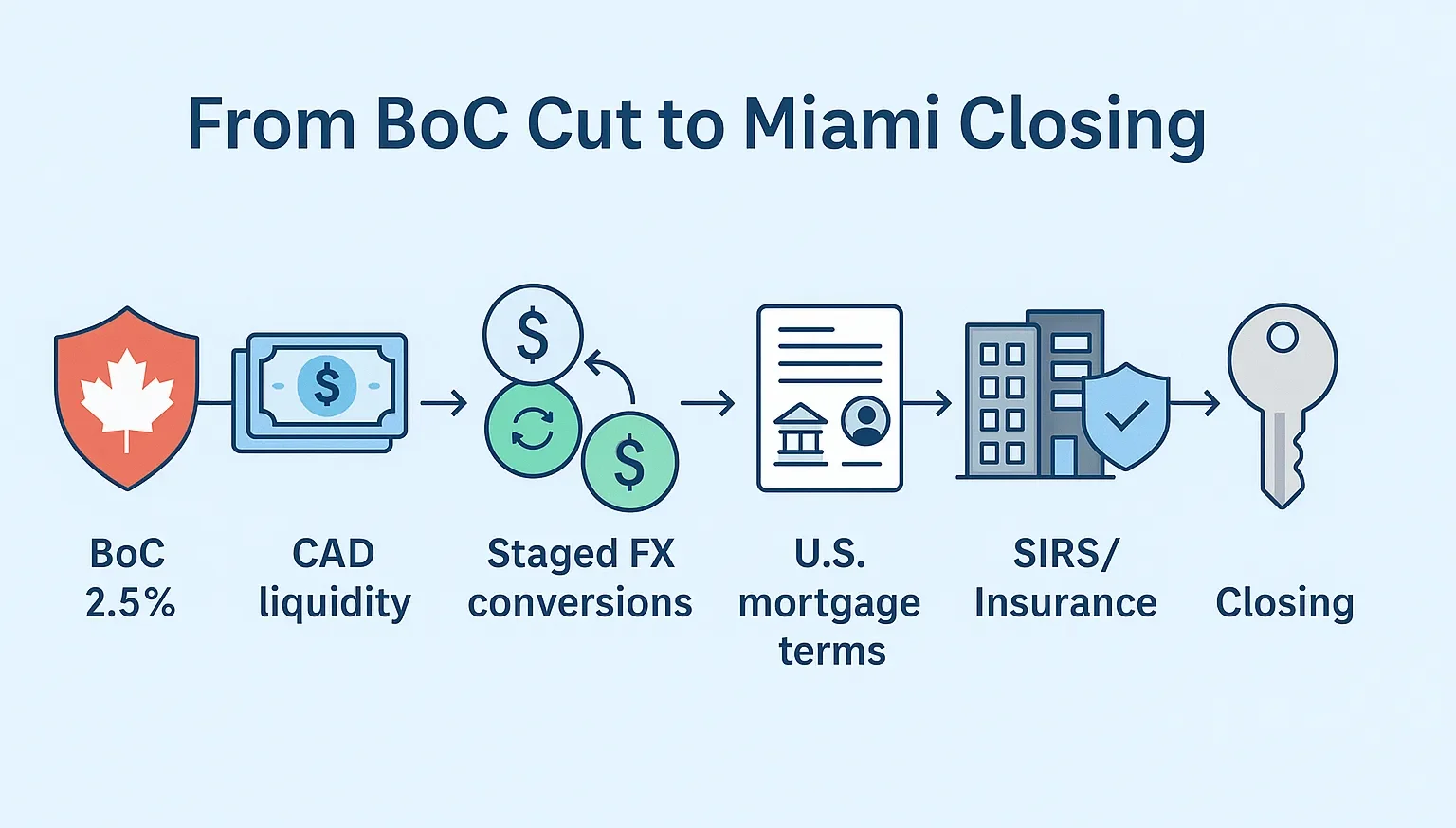

If you’re a Canadian eyeing Miami or South Florida, the bank of canada rate cut 2025 is the green light to revisit your U.S. buying plan. Below, we connect BoC policy, CAD→USD strategy, cross-border mortgages, Florida condo rules (SIRS), insurance, and timing, so you can move with confidence.

What the bank of canada rate cut 2025 means in plain English

The bank of canada rate cut 2025 lowered the overnight rate to 2.5%, improving cash-flow headroom for many Canadians. That doesn’t directly set U.S. mortgage rates, but it does influence three things that matter when you buy in Miami:

- Affordability at home (lower payments on Canadian obligations can help your overall debt ratios).

- CAD→USD (rate differentials nudge currency expectations, which affect your down payment when you convert).

- Timing (policy clarity can give you more confidence to act).

For the official word, see the Bank of Canada’s announcement (Sept. 17, 2025)

Why Canadians are zeroing in on Miami & South Florida in 2025

Miami remains a magnet for lifestyle and investment: warm winters, vibrant culture, no state income tax, and global demand for waterfront living. Crucially for the bank of canada rate cut 2025 crowd, Miami’s 2025 market shows more selection in condos and steady single-family demand, an opportunity set that rewards smart due diligence rather than speed.

To ground your search on bank of canada rate cut 2025 and Miami real estate, browse curated neighborhoods and listings:

- Start with the Miami hub: Top Miami Real Estate

- Explore Edgewater’s bayfront towers and building rules: Edgewater Miami Real Estate

- Prefer leafy streets and marinas? Try Coconut Grove: Coconut Grove Real Estate

- Scan active listings across South Florida: Listing Results

CAD→USD Strategy: turning policy into purchase power

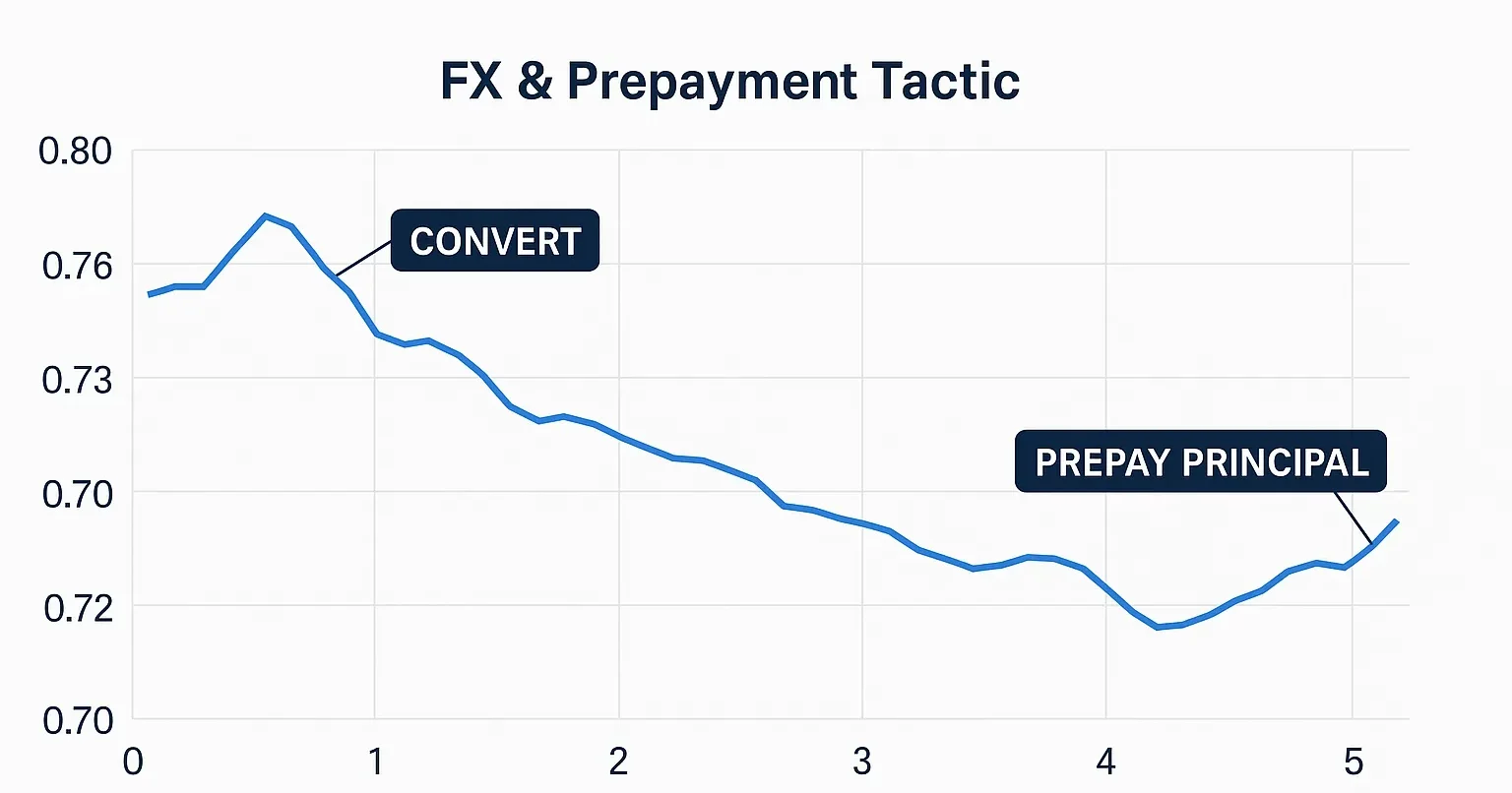

One hidden lesson of the bank of canada rate cut 2025 is that FX timing can rival rate shopping in dollar impact. Treat your down payment like a mini-portfolio:

- Stagger conversions (e.g., 50% at offer, 25% at loan approval, 25% before closing) to smooth currency swings.

- If your lender allows, prepay principal in lump sums when the loonie pops—shrinking interest and USD exposure.

- Consider forward contracts for known closing amounts to reduce last-minute FX anxiety.

- Convert an extra month of USD expenses (HOA/insurance) when CAD is strong, so your first-year budget is insulated.

Want a market-level primer on how to invest smartly in Miami even with the bank of canada rate cut 2025? Try this actionable read: How to Invest in Miami Real Estate in 2025.

Cross-border financing: RBC vs. BMO vs. TD (and when cash is king)

The bank of canada rate cut 2025 may improve Canadian borrowers’ overall profiles, but U.S. lenders still underwrite in USD. Three familiar names keep Canadians’ lives easier:

- RBC U.S. Mortgages for Canadians (Canadian credit history recognized)

- BMO Gateway Program for cross-border buyers.

- TD Bank (U.S.) cross-border home lending

Fixed vs. ARM: Fixed brings stability for snowbirds and families; ARMs may price lower initially. In 2025, pick based on your holding period and risk tolerance, then combine with an FX plan. If you’re comparing investment strategies, this piece pairs nicely: Top Florida Condos for Sale & Investor Strategies 2025.

Cash or HELOC? Some Canadians tap a Canadian HELOC at post-cut rates to fund all-cash or large-down purchases, then refinance later. Others accept a U.S. mortgage for documentation ease and prepayment flexibility to exploit CAD strength later. The best path depends on your tax situation and liquidity needs.

Miami 2025 market snapshot: where the opportunities live

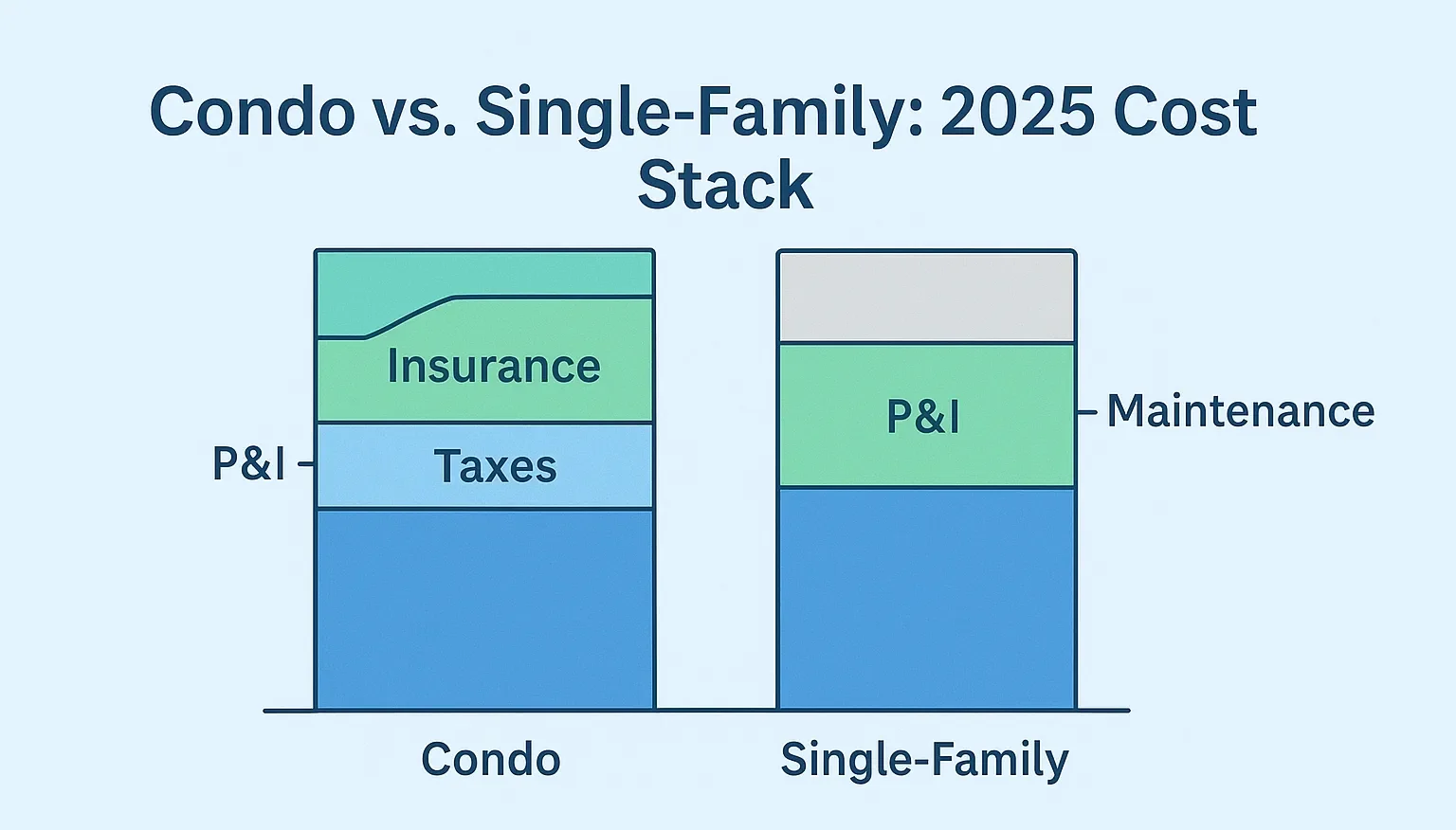

While single-family homes in prime ZIPs hold up, condos show more negotiating room in buildings with older systems or pending capital plans. That dynamic dovetails with the bank of canada rate cut 2025 playbook: you can take your time, compare buildings, and pursue value with diligence.

- Need a pulse on what’s trending? See: Miami Real Estate Market Predictions 2025.

- If your focus is specifically on condos (short-term-rental friendly or waterfront), this guide is a quick win: Condos for Sale Miami-Dade County.

For a broader data lens on bank of canada rate cuts, MIAMI REALTORS® publish market stats and months-of-supply snapshots (their dashboards are gold for buyers):

Florida condo rules (SIRS): the new reality for 2025 buyers

Post-Surfside reforms (SB 4-D/SB 154) created Structural Integrity Reserve Studies (SIRS) and stricter inspection timelines. In 2025, the state clarified standards and extended deadlines to December 31, 2025—that’s fueling a “quality premium” for proactive buildings and a price discovery phase for underfunded ones.

What SIRS means for your wallet

- Higher reserves and more rigorous funding plans can lead to higher HOA fees.

- Buildings with deferred maintenance may face special assessments (already voted or on the horizon).

- Associations with transparent SIRS/Milestone documentation win buyer confidence and financing approvals.

Buyer checklist (SIRS-aware)

- Request the latest SIRS and Milestone reports before escrow.

- Ask for the reserve funding plan and % funded.

- Review the master insurance policy and replacement cost valuations.

- Confirm rental rules (minimum terms, caps, restrictions) if you plan to generate income.

If you want buildings with easier underwriting (newer roofs, robust reserves, clear rental policies), use our neighborhood pages to shortlist SIRS-savvy options:

Insurance in 2025: the swing factor for cap rates and approvals

Florida’s insurance market is healing slowly. The state is actively moving policies out of Citizens (the insurer of last resort) into private carriers, a process called depopulation. That helps availability, but premiums are still elevated, especially on older coastal stock.

- See Citizens’ 2025 depopulation calendar (insurer takeouts):

2025 – Takeout Company (TOC) Personal Lines Depopulation Calendar - News of large policy takeouts (context for market shifts):

Florida approves nearly 229,000 Citizens policies for takeout by private insurers

Smart insurance steps for Canadians

- Quote early—make your offer contingent on an acceptable premium and deductible.

- Ask about wind-mitigation credits, flood zones, and named-storm deductibles.

- Favor buildings with proven reserve funding and updated systems (impact windows, roofs), they often underwrite cleaner.

When you’re ready, we can introduce you to local insurance pros and property managers via our services and real estate expertise.

Taxes & residency: avoid U.S. tax residency with Form 8840

If you love long Miami winters, guard against accidentally meeting the U.S. Substantial Presence Test (SPT). Many Canadian snowbirds file Form 8840 to claim a closer connection to Canada. Keep meticulous day counts and preserve ties (home, licenses, healthcare, clubs).

If you plan to rent your place seasonally, talk to a cross-border CPA about withholding, elections to be taxed on net income, and provincial implications. (We can share referrals just ask via the Blog or our Services page.)

Total cost reality check: model PITI + HOA + reserves + FX

For a realistic first-year budget, combine:

- P&I (based on your U.S. loan type)

- Taxes (county + city)

- Insurance (wind/flood)

- HOA dues and SIRS-driven reserves

- A 5–10% FX buffer for USD expenses if your income is CAD-based

Pro tip for the bank of canada rate cut 2025 era: If the loonie rallies after closing, prepay principal in a chunk. It reduces interest and lowers your USD-denominated carrying cost. An elegant way to transform FX strength into structural savings following bank of canada rate cuts.

Timing your purchase in 2025: three buyer playbooks

- Early-year “inventory hunter”

Target condos where months-of-supply is higher and sellers are more negotiable, after the bank of canada rate cut 2025. Use inspection + insurance contingencies and push for seller credits on known assessments.

Internal picks to monitor: Edgewater, Miami master page, live Listing Results. - Rolling “FX opportunist”

Watch CAD strength around BoC/Fed dates following the bank of canada rate cut 2025. Convert in tranches, then prepay principal when rates move your way. Re-run the numbers with our investment primers:

How to Invest in Miami Real Estate in 2025 and

Condos for Sale Miami-Dade County. - Late-year “policy confirmation”

Let the bank of canada rate cut 2025 path mature and watch insurance repricing as Citizens depop continues. Enter with a clean, well-documented building and lock a fixed rate if you value stability.

Case studies

Toronto Snowbirds | Miami Beach Condo

They leveraged the bank of canada rate cut 2025 to lower HELOC costs at home, staged CAD→USD conversions, and chose an RBC cross-border fixed mortgage. Their building had completed SIRS and transparent reserves, HOA was higher, but surprise risk was lower. They negotiated a small seller credit for a scheduled elevator reserve top-up.

Next steps they took: reviewed neighborhood pages (Miami, Edgewater), then monitored Listing Results.

Calgary Investor | Broward Single-Family Rental

Goal: lower HOA exposure and steadier long-term tenants. They got quotes from two insurers and used wind-mitigation credits to bring the premium down. They compared BMO Gateway vs. TD, then chose the faster close. For taxes, they tracked SPT days and filed Form 8840.

Vancouver Family | Boca Raton Move-Up

They prioritized newer systems (roof, impact windows) to smooth insurance underwriting. They went fixed-rate, staggered currency conversions, and built a USD reserve for first-year HOA and taxes.

Negotiation tactics that work in 2025

- SIRS-aware offers: Ask for SIRS/Milestone and reserve status up front; price in any baseline funding gap.

- Insurance contingency: Cap acceptable premium and deductible in writing.

- Assessment allocation: Get seller to cover existing/approved special assessments or hold a closing escrow.

- Rental rule clarity: Confirm minimum lease terms and caps before deposits—vital if you plan seasonal income.

- Inspection focus: Roof age, flood zone, elevation, and openings (impact windows) are insurance drivers.

When you’re ready to structure a winning offer, we can help you stack the pieces. From property search to negotiation to post-close management, or any info relate to real estate like the bank of canada rate cut 2025.

Quick takeaways

- The bank of canada rate cut 2025 gives Canadians cash-flow slack; translate that into a smart CAD→USD plan and lender choice.

- Condos offer selection; SFHs hold value—win by pairing patience with SIRS-aware due diligence.

- Insurance is the swing cost—quote early, consider wind-mitigation, and use an insurance contingency.

- Keep your SPT day count straight and file Form 8840 to preserve Canadian residency.

- Use neighborhood deep-dives and live inventory to act quickly when the right place appears:

Miami Real Estate, Edgewater, Coconut Grove, Listing Results.

FAQs

1) How does the bank of canada rate cut 2025 help if my U.S. loan is in USD?

Lower Canadian rates can improve your overall debt ratios and free up cash flow for down payment and reserves. Pair that with staged CAD→USD conversions and penalty-free prepayments.

2) What are SIRS and why do they affect prices?

Structural Integrity Reserve Studies force associations to properly fund critical components (roof, waterproofing, etc.). Strong reserves increase HOAs but lower surprise risk, which can stabilize values and financing.

3) Is Miami really a buyer’s market in 2025?

By segment. Many condo buildings show more months of supply than single-family areas. That’s where SIRS, insurance, and building quality separate good value from traps. Compare submarkets using our pages:

Miami, Edgewater, Coconut Grove.

4) Which lender should I choose: RBC, BMO, or TD?

All three serve Canadians. Compare rate + fees + prepayment flexibility and how easily they process Canadian documents. Then layer in your FX plan.

5) How do I avoid becoming a U.S. tax resident as a snowbird?

Track days and file Form 8840 (Closer Connection). Keep strong Canadian ties and consult a cross-border CPA.

Your 2025 action plan

The bank of canada rate cut 2025 isn’t just a headline, it’s a strategy unlock. Use the extra breathing room to stage your CAD→USD, select a cross-border lender that respects your Canadian profile, and run SIRS/insurance-aware diligence so your Miami purchase serves your lifestyle and your spreadsheet. Start by exploring neighborhoods and real-time inventory, then build your team (lender, attorney, inspector, insurance broker) to move decisively when the right opportunity appears.

If you want a seasoned real estate partner to execute that plan end to end, Miami PB Investments can help you shortlist SIRS-savvy buildings, model true carrying costs, and negotiate insurance-aware offers. Ready to move? Contact Miami PB Investments today to book a no-pressure consultation and get your Miami purchase plan in motion.