Currency exchange risk affects every Canadian who buys Miami real estate. You pay in U.S. dollars. You earn and save in Canadian dollars. That gap can help or hurt your returns. This guide shows practical ways to measure, plan, and reduce that risk at every stage: down payment, mortgage, rental income, and resale.

1) What “currency exchange risk” means in real life

Currency exchange risk is the chance that CAD↔USD moves change your investment results. It shows up in four moments:

- Down payment and closing. The rate you get for CAD→USD changes your cost basis.

- Mortgage and expenses. Most payments, taxes, HOA fees, and insurance are in USD.

- Rental income. Rents are usually in USD. Converting back to CAD can boost or cut cash flow.

- Resale and repatriation. Your sale proceeds in USD become more or less valuable in CAD.

Key idea: you don’t control FX. You do control when you convert, how much you keep in USD, and which tools you use to hedge.

2) Map your currency exchange risk exposure before you buy

Start simple. List all the cash flows tied to USD.

- One‑time USD flows: earnest money, deposit schedule, closing costs, furnishings.

- Ongoing USD flows: mortgage, property tax, insurance, HOA, maintenance, management fees.

- USD inflows: rent, security deposits, any local rebates.

- End game: net sale proceeds and capital gains tax payments.

Now tag each flow with timing, amount, and certainty. Near‑term large payments deserve the most currency exchange risk protection. Longer‑dated, smaller or more flexible items can be hedged more lightly.

3) Down payment: lock in your cost basis

The down payment is your first big exposure to currency exchange risk. A 3% rate swing on a USD $500,000 purchase is CAD $15,000+ on the total price. Here’s how to manage it.

Practical tactics

- Stage your conversions. Convert part when the offer is accepted, part before inspection, and the rest two weeks pre‑close. This reduces timing risk.

- Use a forward contract (if available). Lock today’s CAD→USD rate for the specific day you’ll fund escrow or close.

- Keep a margin of safety. Hold 1–2% extra USD for last‑minute adjustments, wire fees, and prorations.

- Open a USD account in Canada. Receive USD, then wire to the U.S. escrow when needed. This avoids double conversions.

Quick sensitivity check

- Property price: USD $500,000

- Rate A: 1.35 CAD/USD → CAD $675,000 cost

- Rate B: 1.30 CAD/USD → CAD $650,000 cost

- Difference: CAD $25,000 on the same home

Your negotiation skills can be undone by an FX swing. Treat the rate like part of the price and be careful of the currency exchange risk.

4) Mortgage and carrying costs: match USD with USD

Monthly payments create ongoing currency exchange risk. You have three paths:

A) Pay mortgage and expenses from USD income

If you plan to rent, try to match USD rent to USD costs. This is a natural hedge. You convert less to CAD and you avoid monthly FX surprises.

B) Convert CAD monthly “just‑in‑time”

Simple, but risky. Your payment cost changes each month with the rate. You can soften this by converting a quarter ahead or by using monthly forwards.

C) Pre‑fund a USD reserve

Hold 6–12 months of mortgage and HOA in a USD account. Refill quarterly or semi‑annually. You reduce the number of conversions and can shop for better rates.

Rate type matters

- Fixed‑rate mortgage: interest cost is stable; FX becomes the swing factor.

- Adjustable‑rate mortgage (ARM): both interest and FX can move. Consider a bigger USD reserve or heavier hedging.

5) Rental income: decide what to convert and when

Canadian snowbirds usually paye rent in USD. That can help if your costs are also in USD. Decide on a conversion policy up front.

- Policy 1: Keep rent in USD. Use it to pay mortgage, tax, HOA, and repairs. Convert to CAD only when you need funds back home.

- Policy 2: Convert a fixed percentage monthly. Example: convert 30% to CAD on the 1st business day each month. Predictable, simple, and disciplined.

- Policy 3: Threshold conversions. Convert only when the CAD strengthens past a target (e.g., ≤1.28). This adds some market timing, so pair it with a reserve.

Tip: Put written rules in your property management instructions so cash doesn’t pile up or get drained by ad‑hoc decisions.

6) Resale and repatriation: protect your outcome

Canadian Investors sell in USD. Their life is in CAD so there is currency exchange risk. Two forces decide the CAD result: sale price and FX at repatriation.

Scenario illustration

- Buy: USD $500,000 at 1.35 → CAD $675,000 cost

- Sell later: USD $575,000 (+15%)

- If CAD strengthens to 1.25 at sale: CAD proceeds ≈ $718,750

- Nominal CAD gain vs cost: ≈ $43,750, before fees and taxes

Same property. Different FX. Your CAD outcome can expand or shrink by tens of thousands. If a sale is likely within 3–12 months, consider layered forwards to lock slices of the planned repatriation amount.

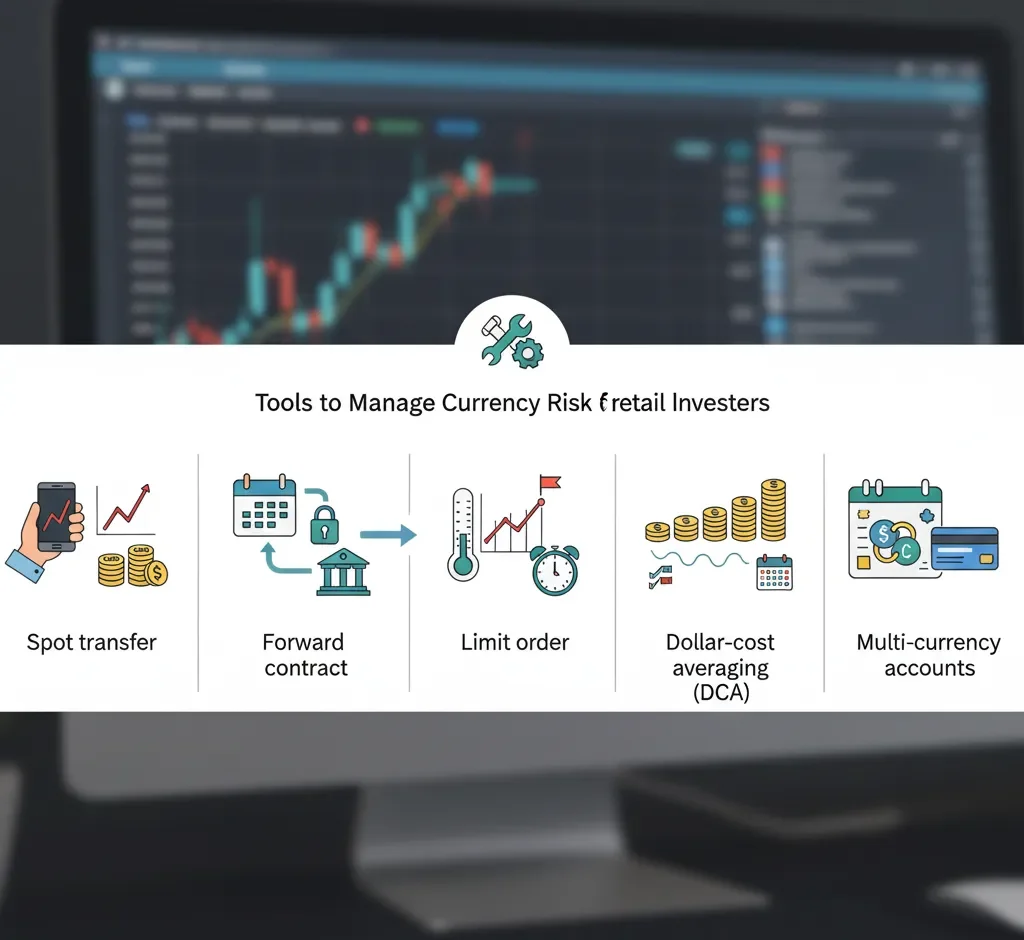

7) Tools to manage currency exchange risk

You don’t need to trade like a hedge fund. Use tools that fit retail investors.

Spot transfer

Convert at today’s rate. Best when amounts are small or timing is immediate.

Forward contract

Lock today’s rate for a set date and amount. Works well for deposits, closing funds, or known mortgage payments. Ask your bank or an FX provider about minimums and collateral.

Limit order

Set a target rate. If the market hits it, your conversion executes. Good for non‑urgent transfers.

Dollar‑cost averaging (DCA)

Convert a fixed amount monthly or quarterly avoiding big currency exchange risk. Reduces timing risk and planning stress.

Multi‑currency accounts

Hold and pay in USD without repeated conversion. Many Canadian banks and brokerages offer this.

Options (advanced)

Protect a worst‑case rate while keeping upside. More complex and can be costly. Usually for larger transactions.

Rule of thumb: hedge what is near in time and large in size. DCA or partial hedges for the rest.

8) Choosing where and how to convert

Rates vary by provider and channel.

- Your Canadian bank: easy, familiar, sometimes wider spreads. (Royal Bank of Canada , National Bank of Canada etc)

- Specialist FX platforms: often tighter spreads and useful tools (forwards, limits).

- Brokerage USD accounts: good for holding USD; check transfer and wire fees.

Compare total cost, not just the headline rate. Include spreads, wire fees, and any account charges. For big tickets like closings, a 0.3% spread improvement on USD $400,000 is USD $1,200 saved.

9) A simple hedging plan you can copy

This staged plan balances ease and protection regarding currency exchange risk.

Before offer

- Open a CAD and USD account at the same institution.

- Price out a specialist FX provider for forwards and limits.

Offer accepted

- Convert 30–40% of expected USD funds.

- Set a limit order for an extra 20% at a better rate.

Two weeks before close

- Use a forward or market transfer to top up remaining funds.

- Keep a 1–2% USD buffer for closing adjustments.

First 12 months of ownership

- Hold 6–12 months of mortgage+HOA in USD.

- Convert monthly rent per your written policy (e.g., keep 70% USD, convert 30% to CAD).

Annually

- Re‑estimate cash flows.

- Hedge the largest known USD needs 3–6 months ahead.

- Adjust targets if your life plans change.

Planning a sale

- Start hedging 25–50% of expected net proceeds once listing is firm.

- Add layers as you approach closing to reduce last‑minute surprises.

10) Taxes and reporting: FX touches your filings

This is not tax advice, but here’s what to note:

- U.S. side: rental income and certain sale proceeds are reported in USD.

- Canadian side: you report worldwide income in CAD using the CRA’s prescribed FX rate method for the period.

- Capital gains: measured in CAD. Your ACB (adjusted cost base) and proceeds must be converted to CAD at the correct dates.

- Records: keep bank confirmations showing FX rates, dates, and fees. It simplifies filings and audit defense.

If you’re unsure, involve a cross‑border tax professional before your first tax year as an owner.

11) Common mistakes (and how to avoid them)

- Converting everything on closing day. You accept whatever rate you gethence a bigger currency exchange risk. Stage conversions instead.

- No USD reserve. One bad month for CAD can blow up cash flow. Hold 6–12 months of costs in USD avoiding currency exchange risk.

- Ignoring small fees. Wires and spreads add up. Shop around and batch transfers.

- Unwritten rules. Ad‑hoc choices become emotional. Write your conversion policy.

- Hedging 100% for years. Over‑hedging can be expensive if plans change. Hedge the near‑term, review the rest quarterly.

- Forgetting exit FX. Plan repatriation hedges once a sale is likely.

12) Worked examples you can reuse

Example A: Cash buyer, staged conversions

- Target buy: USD $800,000

- Timeline: 45 days to close

- Plan: convert 40% at offer, 30% at inspection clear, 25% via 30‑day forward, 5% buffer.

- Outcome: blended rate reduces timing risk; buffer covers fees and last‑minute prorations.

Example B: Mortgaged buyer with rent

- Net annual USD costs: USD $48,000 (mortgage, HOA, tax, insurance)

- Expected rent: USD $54,000

- Policy: keep USD rent in‑market to auto‑pay costs; convert excess quarterly using a limit order.

- Hedge: pre‑fund 6 months of costs; top up with forwards if vacancies rise.

- Benefit: natural hedge minimizes monthly CAD conversions and currency exchange risk.

Example C: Resale with layered hedge

- Anticipated proceeds: USD $600,000 in 4 months

- Strategy: hedge 25% now, 15% next month, 10% two months out, rest at close.

- Result: you avoid a single “all‑or‑nothing” FX bet while staying flexible if the closing date moves.

13) Quick math: see how FX changes returns

Use this back‑of‑the‑envelope to forecast:

- CAD cost basis = USD purchase price × FX rate at conversion + transaction costs (in CAD).

- Annual CAD cash flow = (USD rent − USD costs) × average FX rate you use for conversions.

- CAD sale proceeds = (USD sale price − USD selling costs) × FX rate when repatriated.

- CAD total return ≈ (CAD cash flow over hold) + (CAD sale proceeds − CAD cost basis).

Then run two FX scenarios (stronger CAD, weaker CAD). Plan hedges around the range you can’t afford to miss.

14) FAQ: fast answers for common worries

Q: Should I convert everything at once or in parts?

A: In parts as there is less currency exchange risk. Stage conversions and use a small forward for closing certainty.

Q: Are forward contracts accessible to individuals?

A: Often yes, through banks or FX providers. Minimums and collateral vary. Ask early.

Q: How big should my USD reserve be, to avoid currency exchange risk?

A: Aim for 6–12 months of mortgage+HOA+insurance. Bigger if your income is mostly CAD.

Q: What if CAD strengthens after I lock a forward?

A: You gave up some upside to remove downside. Hedge only what you must, and layer hedges.

Q: Should I keep rental income in USD or convert it?

A: Keep enough USD to cover USD costs. Convert the surplus on a schedule or at target rates.

Q: Can I hedge a possible sale two years from now?

A: Long‑dated hedges get costly and rigid. Start once a sale is probable and use layers.

15) A short, repeatable checklist

- List all USD inflows and outflows by date.

- Open a USD account; compare rates across providers.

- Write a conversion policy (percentages, timing, thresholds).

- Stage down‑payment conversions; add a forward for closing.

- Hold a 6–12 month USD reserve for costs.

- Match USD rent to USD expenses first.

- Review hedges quarterly; adjust for life changes.

- Save proof of each conversion (rate, date, fees).

- Before listing to sell, plan layered hedges for proceeds.

- After the sale, repatriate per plan and close out hedges.

16) Key takeaways

- Currency exchange risk is part of the price you pay and the return you keep.

- Protect large, near‑term payments with staged conversions and selective forwards.

- Use natural hedges: pay USD costs with USD income.

- Keep a USD reserve so monthly living isn’t hostage to the rate and currency exchange risk.

- Plan repatriation before you sell, not after the offer is signed.

- Write this down for minimal currency exchange risk. Then follow the plan.

Final note

This guide is for education on currency exchange risk. It is not financial, legal, or tax advice. Cross‑border purchases have rules that changeovertime. Confirm details with your bank, FX provider, or contact a cross‑border tax professional.