Real estate investment is a proven path to wealth creation. Yet, it’s not without its complexities and challenges. Understanding the strategies for maximizing returns is crucial. It can make the difference between a profitable investment and a costly mistake. In this guide, we delve into various real estate investment strategies. We explore how to identify lucrative opportunities and manage a diverse property portfolio. We will talk about the legal aspects of real estate investing. This includes the significance of having a real estate fraud attorney. We will also cover how to comprehend real estate’s return on investment.

For those considering a career in Real Estate Investment Strategies, we explore the best-paying jobs in real estate investment trusts. We also discuss the NAICS code for real estate investment strategies. Whether you’re experienced or new to investing, this guide has helpful tips for navigating real estate investment.

Understanding Real Estate Investment Strategies

Real estate investment strategies are plans that guide your investment decisions. They help you identify the right properties, manage risks, and maximize returns over time. These strategies may include buying rental properties, flipping homes, wholesaling, or investing in REITs. Different strategies work for different investors based on their available capital, preferred level of involvement, market conditions, and income goals. Choosing the right strategy requires a clear understanding of your long-term objectives, risk tolerance, and time horizon. Successful investors often blend multiple strategies to adapt to shifting market trends.

The Importance of Location in Property Investing

Location is a key factor in property investing and can significantly affect your bottom line. It influences property values, rental income potential, and long-term appreciation. A prime location typically has access to transportation, quality schools, retail centers, and growing employment opportunities. Investors should also evaluate crime rates, zoning laws, and future development plans. Emerging neighborhoods with planned infrastructure projects or commercial growth can offer high upside for appreciation. A good location doesn’t just increase property value, it also reduces vacancy rates and attracts reliable tenants.

Diversifying Your Property Portfolio

Diversification is a risk management strategy. It involves spreading your investments across different types of properties and locations. A diversified portfolio can withstand market fluctuations. It provides multiple income streams and reduces the impact of a single property’s performance.

Residential Rentals vs. Commercial Real Estate

Residential rentals and commercial real estate offer different benefits. Residential properties can provide steady rental income and are generally easier to manage. Commercial properties, on the other hand, often yield higher returns. They have longer lease agreements and less tenant turnover. However, they require a larger initial investment and more management expertise.

Innovative Investment Opportunities

The real estate sector is evolving rapidly, driven by digital platforms and changing investor behavior. New investment opportunities are emerging, thanks to technology and innovative business models that make real estate more accessible than ever. From tokenized real estate assets on blockchain to real estate investment mobile apps, these advancements are breaking traditional barriers to entry. These opportunities offer flexibility in terms of investment amounts, geographic reach, and risk profiles. For small investors or those new to the field, these tools provide a safer and more transparent path to building a diverse real estate portfolio with strong potential for returns.

Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms are a game-changer. They allow investors to pool funds and invest in properties they couldn’t afford individually. These platforms offer a variety of investment options. They provide detailed property information, making it easier for investors to make informed decisions.

The Rise of Real Estate Syndication

Real estate syndication is another innovative Real Estate Investment Strategies. It involves a group of investors pooling resources to invest in larger, more profitable properties. The syndicator manages the property and the investors share the profits. This strategy allows investors to participate in high-value real estate deals with a smaller initial investment.

Financial Metrics and Legal Considerations

Understanding financial metrics is crucial in Real Estate Investment Strategies. They help investors assess the profitability of an investment. Legal considerations are equally important. They protect investors from potential fraud and legal disputes.

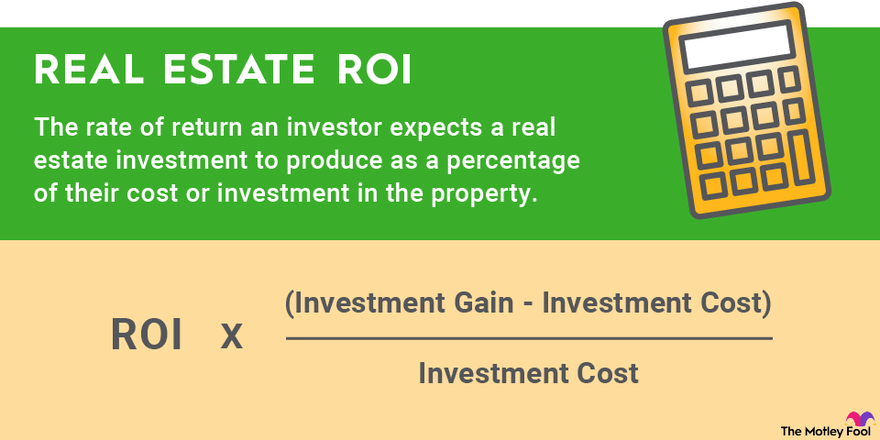

Calculating Real Estate ROI

Return on Investment (ROI) is a key metric in real estate that tells you how effectively your money is working for you. It measures the return on an investment relative to its cost and is typically expressed as a percentage. To calculate ROI, subtract all property-related expenses (like mortgage payments, taxes, repairs, and insurance) from the total income earned, then divide that profit by the total investment cost. A strong ROI indicates that your property is generating healthy returns, making it a valuable decision-making tool when comparing different opportunities.

The Role of a Real Estate Investment Fraud Attorney

A real estate investment fraud attorney is a legal professional who specializes in real estate fraud cases. They help investors recover losses from fraudulent activities. They also provide legal advice to investors. This helps prevent potential fraud and ensures compliance with real estate laws and regulations.

Career Paths in Real Estate Investment

Real estate investment offers a variety of career paths. These range from property management to investment analysis. Each role requires a unique set of skills. Understanding these roles can help you find the best fit for your career goals.

Exploring Real Estate Investment Jobs

Jobs in real estate investment strategies are diverse. They include roles in property management, real estate brokerage, and investment analysis. Each role offers unique opportunities. For example, property managers oversee rental properties, while investment analysts evaluate potential investments.

Is Real Estate Investment Trusts a Good Career Path?

Real Estate Investment Trusts (REITs) offer promising career paths. They provide opportunities for both financial and real estate professionals. Working in a REIT can offer exposure to a variety of real estate assets. It also provides opportunities for career growth and development.

Avoiding Common Pitfalls

Investing in real estate can be risky. Being aware of common pitfalls is crucial to avoid losses. Understanding these pitfalls can help you make informed decisions. It can also help you maximize your returns.

Common Mistakes in Real Estate Investment Strategies

One common mistake is not conducting thorough research. This can lead to a poor real estate investment strategies decision. Another mistake is not considering all costs. These include maintenance, taxes, and insurance.

How to Avoid Real Estate Investment Fraud

Real estate investment fraud can lead to significant losses. It’s crucial to know how to avoid it. Always research before investing. Make sure the investment is legitimate and the people involved are trustworthy.

Building a Successful Real Estate Investment Strategy

Building a successful real estate investment strategy requires knowledge, research, and patience. Understanding the market, diversifying your portfolio, and making informed decisions are important. Remember, real estate investment is not a get-rich-quick scheme. It’s a long-term commitment that can yield significant returns if managed properly. Stay informed, stay vigilant, and your real estate investment journey can be a rewarding one.