Picture this: You’re bundled up in your Toronto apartment, watching another February blizzard dump snow outside your window, when your phone buzzes. It’s a notification from your Miami property manager, your Brickell condo just rented for $4,800 a month, and it’s 82°F and sunny down there.

This isn’t some fantasy scenario. It’s exactly what happened to Jennifer and Mark Chen last winter, and they’re just one of thousands discovering that Canadians buying homes in the US isn’t just about escaping Canadian winters anymore, it’s become one of the smartest investment moves you can make in 2025.

Here’s something that might surprise you: Canadians buying homes in the US now represents the largest segment of foreign real estate investment in America, with our neighbors to the south contributing a whopping $53 billion in 2023 alone. But here’s the kicker, most Canadians still don’t realize just how accessible and profitable this opportunity has become.

The Miami Magic That’s Captivating Canadian Buyers

So why is Miami stealing the hearts (and wallets) of Canadian investors? Well, it turns out Miami isn’t just another sunny destination, it’s been ranked the #2 top housing market in the entire United States for 2025. That’s not just some random statistic thrown around by real estate agents trying to make a sale. It’s backed by serious market data that shows Canadians buying homes in the US, particularly in Miami, are sitting pretty right now.

Take Sarah Rodriguez from Calgary. She was skeptical at first, aren’t we all when something sounds too good to be true? But after crunching the numbers on a Brickell condo that cost her $485,000 USD (about $655,000 CAD after conversion), she realized she’d saved over $300,000 compared to anything decent in downtown Calgary. “I kept thinking there had to be a catch,” Sarah laughs. “But two years later, my rental income covers my mortgage, I’ve got my winter escape sorted, and the property’s already appreciated by $65,000. Sometimes the obvious choice really is the right choice.”

Why 2025 is Different and Why You Should Pay Attention

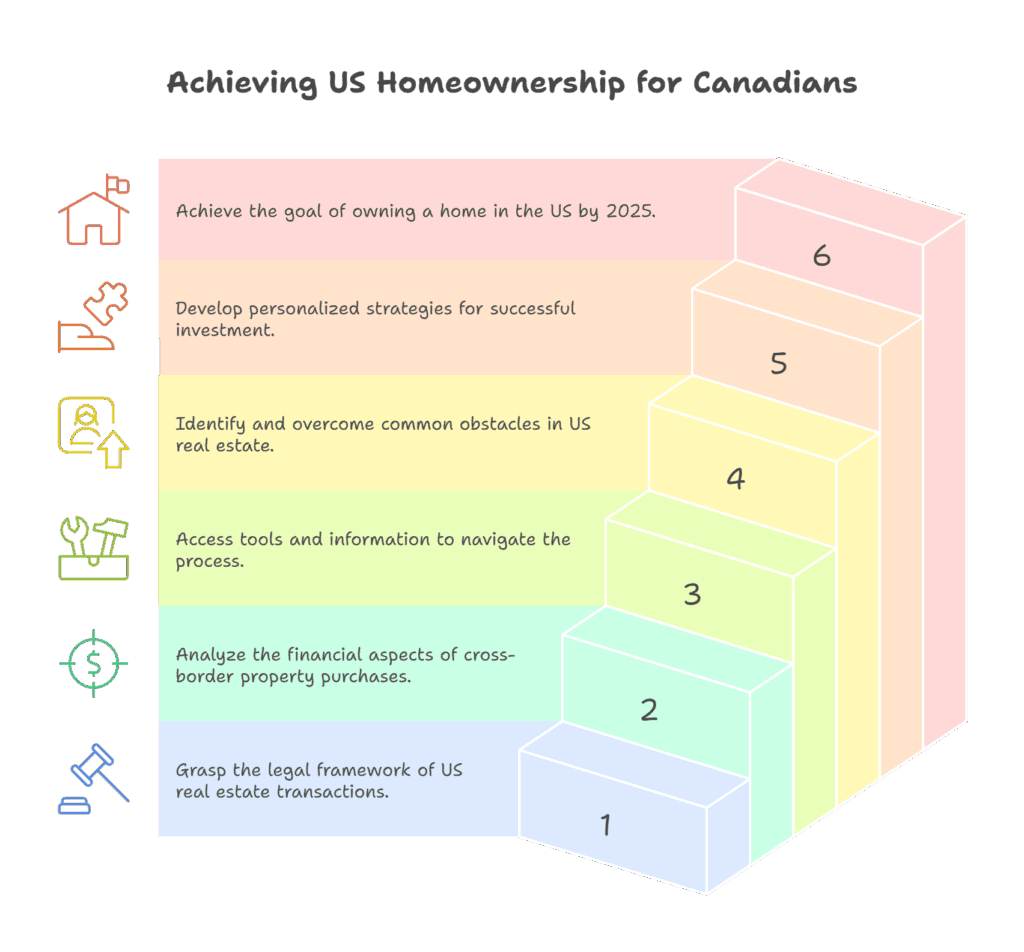

Now, I know what you’re thinking. “Sounds great, but is this really the right time?” Fair question. Here’s why Canadians buying homes in the US in 2025 might be one of those opportunities you’ll kick yourself for missing:

Market Conditions That Actually Favor Buyers:

- Inventory is up 22.6% year-over-year (more choices for you)

- A staggering 94-95% of homes are selling at or below asking price (goodbye, bidding wars!)

- The Canadian dollar has strengthened moderately against the USD in 2025

- Interest rates are expected to drop from 6.6% to 5.7% by year-end

Investment Returns That Make Your RRSP Jealous

While your Canadian investments are struggling to hit 4% returns, Miami real estate is delivering average rental yields of 6.68%. That’s not a typo, we’re talking about nearly double what you’d expect from Toronto or Vancouver rental properties.

But let’s be real for a minute. This isn’t about following some get-rich-quick scheme or jumping on the latest investment bandwagon. Canadians buying homes in the US successfully are doing their homework, understanding the process, and working with people who know both markets inside and out.

Can a Canadian Buy a House in the US? Breaking Down the Legal Reality

Okay, let’s tackle the elephant in the room first. Can a Canadian buy a house in the US without jumping through a million legal hoops or needing some special status? The short answer is absolutely yes, and it’s probably way easier than you think.

I remember chatting with David Park, a software consultant from Edmonton, who spent six months convinced he needed some sort of investor visa or special permit. “I was researching immigration lawyers and complex visa applications,” he told me over coffee. “Turns out, I was overthinking it completely. All I needed was my passport and some paperwork.”

The Legal Framework is Actually Pretty Straightforward

Here’s the thing about canadian buying house in us transactions, the United States doesn’t put up barriers for Canadian real estate investment. In fact, they welcome it with open arms because it brings capital and economic activity into local communities.

Your Rights as a Canadian Buyer:

- You own the property outright, just like any American citizen would

- You can rent it out, renovate it, or sell it whenever you want

- You can pass it on to your kids or include it in your estate planning

- There are no weird restrictions or annual fees for being a foreign owner

What You Actually Need:

- Your Canadian passport (obviously)

- An Individual Taxpayer Identification Number (ITIN) from the IRS

- Proof that your money is coming from legitimate sources

- A US bank account (which Canadian banks make super easy to set up)

The 2025 Updates You Should Know About

Now, there have been some changes in 2025 that affect canadians buying homes in the us, but they’re not deal-breakers. Starting this April, if you’re planning to spend more than 30 days at a time in the US, you’ll need to register with USCIS. It’s basically just paperwork, nothing that should scare you away from a good investment.

There’s also been some noise about foreign buyer restrictions in Florida, but here’s the important part: can Canadian citizen buy house in USA without worrying about these restrictions? Absolutely. The Florida legislation that passed (SB 264) specifically targets certain countries that are definitely not Canada. We’re talking about restrictions on buyers from China, Russia, Iran, countries that don’t exactly have the same friendly relationship with the US that we do.

Banking Made Simple (Finally!)

Remember when international banking felt like you needed a PhD in finance just to move money between countries? Those days are mostly over, especially for Canadian purchasing US real estate. The major Canadian banks have figured out that Canadians want to invest south of the border, and they’ve made it surprisingly painless.

RBC’s Cross-Border Banking costs about $40 a year and gives you instant transfers, access to 50,000+ ATMs without fees, and dedicated support for exactly these kinds of transactions. TD and BMO have similar programs, and honestly, the competition between them has made things better for all of us.

Lisa Wong from Vancouver put it perfectly: “I was dreading the banking nightmare stories I’d heard from friends. But setting up my US account through TD took about 20 minutes online, and transferring money for my down payment was literally as easy as an e-transfer between Canadian accounts.”

Market Opportunities: Where Canadians Buying Homes in the US Find the Best Deals

Let’s talk numbers for a minute, because this is where Canadians buying homes in the US story gets really interesting. I’ve been watching real estate markets for over a decade, and I’ve rarely seen value propositions this compelling.

The Price Reality Check

When I show Canadian clients the price comparisons, their reaction is usually something like, “Wait, run those numbers again.” So let me break it down for you:

What $650,000 CAD Gets You:

- In Toronto: Maybe a decent 1-bedroom condo downtown, no parking, no amenities

- In Vancouver: A nice view of a parking lot from your 700-sq-ft “luxury” apartment

- In Miami: A 1,200-sq-ft condo with water views, pool, gym, concierge, and year-round sunshine

I’m not exaggerating these numbers. Michael and Susan Torres from Mississauga just closed on a gorgeous 2-bedroom in Aventura for $525,000 USD. “We looked at comparable places in Toronto,” Michael explains. “We’re talking $1.2 million minimum for anything close to this quality. And that’s assuming you could find something with a pool and gym included.”

The Neighborhoods Where Smart Money is Going

Brickell: The Manhattan of Miami

This is where young professionals and savvy investors are flocking. We’re seeing median prices around $638,000 to $746,000 USD, but here’s the kicker, you’re getting luxury amenities that would cost extra in Toronto, plus you’re in the heart of Miami’s financial district.

Jennifer Kim, a marketing director from Calgary, bought here in 2023. “The rental demand is insane,” she says. “I list my unit and have multiple applications within 48 hours. Try finding that kind of demand in Calgary!”

Aventura: Where Canadian Families Feel at Home

If Brickell is Miami’s Manhattan, Aventura is like its version of North York, family-friendly, well-planned, and surprisingly affordable. Median prices are sitting around $525,000 to $550,000 USD, and get this 89% of the housing stock is high-rise condos with resort-style amenities.

Coral Gables: Old Money Meets New Investment

This is the pricier option, with medians around $1.33 million to $1.4 million USD, but the appreciation has been incredible. We’re talking 32.9% to 43.9% year-over-year growth. It’s like buying in Forest Hill or Westmount, but with palm trees and no snow removal fees.

Fort Lauderdale: The Venice of America (And Your Wallet Will Thank You)

For those who want ocean access without Miami Beach prices, Fort Lauderdale delivers. Median prices around $520,000 to $646,000 USD get you into the boating lifestyle that would cost millions in Toronto’s harbour front.

Investment Returns That Make Sense

Here’s where Canadians buying homes in the US really hits home. While Canadian rental properties are delivering yields that barely beat inflation, Miami properties are generating 6.68% average rental yields.

Dr. Patricia Chen from Montreal owns both a rental condo in downtown Montreal and one in Brickell. “The Montreal property generates about 3.2% yield on a good year,” she explains. “The Miami property? I’m getting 8.1% yield, and the tenants stay longer because they’re not dealing with Quebec’s rental regulations that favor tenants over landlords.”

The occupancy rates tell the story too:

- Miami: 96.6% average occupancy

- Average vacancy between tenants: 36 days

- Compare that to some Canadian markets where you might wait 60-90 days between tenants

Financing Your Dream: How Canadians Buying Homes in the US Actually Make it Happen

Now we get to the part that used to be a real headache but has gotten so much better in recent years. Canadian buying house in US financing isn’t the nightmare it once was, thanks to Canadian banks figuring out there’s serious money to be made helping their customers invest internationally.

Your Canadian Bank Wants to Help (Seriously)

RBC Bank’s US Division has become incredibly popular with Canadian buyers. Here’s what caught my attention: they’re offering up to $4,500 USD in closing cost credits through October 2025. That’s real money back in your pocket just for choosing them.

Sarah and Tom Wilson from Ottawa used RBC’s program for their Aventura purchase. “The process felt like getting a mortgage in Canada,” Sarah explains. “They used our Canadian credit history, accepted our Canadian income documentation, and the whole thing took about six weeks. No different than buying in Ottawa, except we were getting a place in paradise.”

What the Requirements Actually Look Like:

- Down payment: 20% for vacation homes, 25% for investment properties

- They’ll use your Canadian credit score (no need to build US credit first)

- Canadian income and employment verification works fine

- Processing time: 40-45 days, which is pretty reasonable

BMO’s Gateway Program covers 16 states including Florida, with similar terms. TD Bank’s Cross-Border Solutions might be even smoother if you’re already a TD customer, since they have such a big US presence.

US Lenders Who “Get” Canadian Buyers

HSBC Bank USA has been really impressive for higher-end purchases. They’ll lend up to $5 million, which opens doors for luxury properties or multi-unit investments. The best part? They don’t require US credit history at all—they use international credit assessment models.

America Mortgages specializes exclusively in foreign national mortgages, and they’ve developed specific programs for Canadian buyers. They understand things like how Canadian employment works, why our tax returns look different, and how to verify Canadian assets.

The Interest Rate Reality (It’s Not As Bad As You Think)

Current rates for canadian buying property in usa are sitting around:

- Vacation home mortgages: 6.25% to 7.25%

- Investment properties: 6.75% to 7.75%

Yes, that’s higher than Canadian rates, but here’s the thing—rates are expected to drop to around 5.7% by the end of 2025. Plus, when you factor in the rental income potential and tax benefits, the numbers often work out better than Canadian investments anyway.

Cash vs. Financing: The Strategic Decision

About half of the Canadians buying homes in the US that we work with go the cash route, and there are real advantages:

- Faster closing (15-30 days vs. 45-60 days)

- Stronger negotiating position (sellers love cash offers)

- No financing contingencies to worry about

- Simpler tax situation

But financing can make sense too, especially if you want to preserve cash for other investments or if you’re buying multiple properties.

Currency Strategy That Actually Works

This is where a lot of Canadians mess up. The CAD/USD exchange rate is sitting around 1.3680 to 1.3719 right now, which is actually pretty favorable for us. But currency can move against you between signing a contract and closing.

Smart buyers use forward contracts to lock in their exchange rate, especially for large purchases. Tom and Marie Dubois from Quebec locked in their rate when they signed their contract. “The rate moved against us by 2 cents during the three-month closing period,” Tom explains. “The forward contract saved us about $8,000 on our $400,000 purchase. Best insurance policy we ever bought.”

Tax Strategy: Making Canadians Buying Homes in the US Work for Your Wealth

Okay, let’s talk about everyone’s favorite topic, taxes. Just kidding, nobody loves talking taxes, but when it comes to Canadians buying homes in the us, understanding the tax implications can literally save you tens of thousands of dollars over time.

The US Side: It’s Actually Pretty Investor-Friendly

First thing you need to know: Canadian buying house in USA means you’ll need an Individual Taxpayer Identification Number (ITIN) from the IRS. Think of it like a SIN number for US tax purposes. It takes about 7-11 weeks to get, so start early.

Property Taxes in Miami

Miami-Dade County charges about 1.02% annually on assessed value. So on a $500,000 property, you’re looking at roughly $5,100 per year. Now, before you start comparing that to Toronto’s 0.66% rate, remember, Florida has no state income tax. That’s huge when you’re generating rental income.

FIRPTA: The Exit Tax You Should Know About

When you eventually sell your US property, they’ll withhold 10-15% of the sale price under something called FIRPTA (Foreign Investment in Real Property Tax Act). Don’t panic, this is just a prepayment of your capital gains tax. You’ll get back whatever you overpaid when you file your US tax return.

The Rental Income Sweet Spot

Here’s where it gets interesting. If you rent out your US property, you can elect to treat that rental income as business income (Section 871(d) election). This lets you deduct all your operating expenses, property management, maintenance, insurance, even depreciation.

Dr. Michael Chang from Toronto owns a Brickell rental that generates $54,000 annually. After expenses and depreciation deductions, his taxable income is only about $28,000, resulting in roughly $4,200 in US federal taxes. That’s an effective rate of 7.8% on his gross rental income.

The Canadian Side: Reporting Without Double Taxation

Form T1135 is your friend (well, as much as any tax form can be). If your US property is worth more than $100,000 CAD, you need to file this annually. It’s not complicated, but the penalties for missing it are nasty—$25 per day, up to $2,500.

Rental Income Reporting

You report all your US rental income on your Canadian tax return, but here’s the beautiful part, you get foreign tax credits for any US taxes you paid. The Canada-US Tax Treaty is designed to prevent double taxation.

Capital Gains When You Sell

Canada taxes 50% of your capital gains, but again, you get credits for US taxes paid. The key is keeping detailed records of all your purchase costs, improvements, and selling expenses.

Estate Planning: The Billion-Dollar Oversight

This is where many canadians buying homes in the us make a costly mistake. US estate tax kicks in at just $60,000 for Canadians (compared to $13.61 million for US citizens). On an $800,000 Miami property, your estate could face nearly $230,000 in US estate taxes.

Simple solutions:

- Create a US will specifically for your US property

- Consider LLC ownership for larger properties

- Look into life insurance to cover potential estate taxes

- Work with a cross-border estate planner

Maria and Carlos Santos from Vancouver discovered this during their planning process. “We almost made a $200,000 mistake,” Maria admits. “Our cross-border tax advisor showed us how proper structuring could save our kids a fortune in estate taxes. Worth every penny of the planning fees.”

The Real Talk: Canadians Buying Homes in the US Pros and Cons

Let’s be honest about this whole Canadians buying homes in the US thing. I’ve seen enough transactions to know that while the opportunities are real, this isn’t some risk-free money-printing machine. Smart investors understand both sides of the equation.

The Upside That Gets People Excited

Financial Returns That Actually Make Sense:

We’ve covered this, but it bears repeating, 6.68% rental yields in Miami versus 2.8-3.2% in Toronto or Vancouver. That’s not just a small difference; that’s the difference between building wealth and barely keeping up with inflation.

Lifestyle Benefits You Can’t Put a Price On:

Sure, everyone talks about the weather, but it goes deeper than that. Dr. Sandra Wilson moved from Ottawa to spend seven months a year in South Beach. “My husband’s arthritis has improved dramatically,” she explains. “We’re saving money on medications, we’re more active, and honestly, our social life is better than it ever was in Ottawa.”

Tax Advantages That Add Up:

Florida’s lack of state income tax isn’t just marketing fluff. For rental income, that’s 5-13% more you keep compared to high-tax states. Add in depreciation benefits and expense deductions, and the tax situation often works in your favor.

Currency Diversification:

When the Canadian dollar weakens (and it does), your US property becomes more valuable in CAD terms. Plus, rental income in USD provides a natural hedge against currency fluctuations.

The Challenges Nobody Likes to Talk About

Currency Risk Cuts Both Ways:

Yes, CAD weakness helps your investment value, but CAD strength hurts your returns when you convert USD rental income back to CAD. Mark and Lisa Thompson from Halifax learned this the hard way. “When we bought, the exchange rate was 1.40,” Mark explains. “Now it’s 1.37, which sounds small, but it affects every rent payment we receive.”

Distance Management Isn’t Always Easy:

Professional property management typically costs 8-12% of rental income. Then there are the emergency calls at 2 AM when a pipe bursts or the air conditioning dies during a heat wave.

Frank Morrison from St. John’s found this out during Hurricane Ian: “The property manager handled most of it, but I was still awake all night coordinating insurance claims and emergency repairs from 2,000 miles away. It’s not impossible, but it’s not stress-free either.”

Tax Complexity is Real:

Cross-border tax preparation typically runs $2,000-$5,000 annually. Mistakes can be expensive, the IRS and CRA don’t mess around with foreign reporting requirements.

Insurance Costs in Paradise:

Hurricane insurance in Florida can run $2,000-$8,000 annually depending on your property’s location and value. Flood insurance is extra if you’re in a flood zone. It’s not deal-breaking, but it adds up.

Market Risks You Should Consider:

Miami’s economy depends heavily on tourism, international business, and population growth. Economic downturns can hit harder in markets that rely on discretionary spending.

Making the Decision Work for You

Canadian buying property in USA comes down to honest self-assessment:

You’re Probably a Good Candidate If:

- You’re comfortable with complexity and professional management

- You have adequate reserves for unexpected expenses

- You understand currency risk and can handle volatility

- You’re looking at this as a 5-10 year investment minimum

- You can afford to lose the property value without financial ruin

You Should Probably Wait If:

- You need the rental income to cover the mortgage from day one

- You don’t have emergency reserves in both CAD and USD

- You’re uncomfortable with cross-border tax compliance

- You want to manage the property hands-on yourself

- You’re looking for a quick flip or short-term gain

Success Stories From Real Buyers

David and Jennifer Park from Calgary now own three Miami properties. “We started with one vacation condo in 2021,” David explains. “The returns were so good that we bought two more as pure investments. Yes, it’s more complex than owning Canadian rental properties, but the returns justify the effort.”

Their strategy: Professional property management from day one, adequate reserves in USD accounts, annual tax planning reviews, and a long-term outlook that doesn’t get rattled by short-term currency or market movements.

Working with Miami PB Investments: Your Canadian Home-Buying Partner

Here’s the thing about Canadians buying homes in the US, having the right team makes all the difference between a smooth transaction and a stressful nightmare. After working with hundreds of Canadian buyers, we’ve learned exactly what you need to succeed.

Why Canadian Buyers Need Specialized Help

I learned this lesson early in my career when I tried to help a couple from Toronto using the same approach I used for local buyers. Big mistake. They had questions about currency conversion timing, needed help coordinating with their Canadian accountant, and were worried about cross-border tax implications that I’d never dealt with before.

That experience taught me that Canadian buying house in US isn’t just about finding properties, it’s about understanding the complete cross-border picture.

Our Canadian-Focused Approach

Market Analysis That Makes Sense to Canadians:

We don’t just show you Miami prices, we help you understand value propositions compared to Toronto, Vancouver, Calgary, or wherever you’re coming from. Our market reports include currency-adjusted comparisons and ROI analysis using metrics that Canadian investors actually use.

Professional Network Built for Cross-Border Success:

Over the years, we’ve built relationships with immigration attorneys who understand Canadian needs, cross-border tax specialists who work with both the CRA and IRS, and property managers who have experience with Canadian investors.

Transaction Coordination That Eliminates Stress:

We handle the parts that trip up most international buyers—ITIN applications, currency conversion timing, wire transfer coordination, and making sure nothing falls through the cracks because of time zone differences or different banking systems.

Real Success Stories

The Calgary Tech Entrepreneur: David Park initially thought he could handle everything himself using online resources. After six months of confusion and false starts, he found us. “Miami PB understood my business travel schedule, coordinated viewings during my US trips, and helped structure the purchases to optimize my Canadian tax situation,” he explains. Three years later, his three Miami properties are outperforming his Calgary real estate investments significantly.

The Montreal Retirees: Dr. Marie and Claude Dubois were nervous about buying in a foreign country with limited English. We connected them with French-speaking professionals and patiently explained every step. “They understood our Quebec tax situation and helped us structure everything properly,” Marie says. “Now we spend our winters in paradise and our summers in Montreal.”

The Vancouver Investment Group: Five Vancouver professionals pooled resources to purchase a luxury South Beach rental property. Coordinating multiple Canadian investors for a US purchase seemed impossible until we helped them understand partnership structures, tax implications for each partner, and ongoing management requirements.

Our Reliable Service Framework

Phase 1: Strategy and Planning

- Initial consultation to understand your goals and situation

- Market education tailored to your Canadian perspective

- Financial strategy development considering currency, taxes, and financing

- Professional team assembly with cross-border specialists

Phase 2: Property Search and Evaluation

- Customized search based on Canadian-specific criteria

- Virtual tour coordination for initial property screening

- In-person visit planning that maximizes your time

- Comparative market analysis with Canadian context

Phase 3: Acquisition and Closing

- Offer strategy and negotiation with cross-border considerations

- Contract review focusing on Canadian buyer protection

- Closing coordination and document management

- Currency conversion timing and wire transfer execution

Phase 4: Ownership and Management

- Property management setup and ongoing oversight

- Investment performance monitoring and reporting

- Tax compliance support and professional coordination

- Strategic advice for portfolio expansion

Technology That Bridges the Distance

Understanding that Canadians buying homes in the US often involves managing everything from thousands of miles away, we’ve invested in technology that makes the process smoother:

- Secure client portals for document sharing and transaction tracking

- High-quality virtual property tours for initial screening

- Video conference capabilities for consultations and meetings

- Digital closing processes that eliminate unnecessary travel

Why Our Clients Choose Us Again and Again

“More Than Just Real Estate Agents” – Susan Wright, Toronto

“Miami PB didn’t just help us buy a condo, they helped us understand how US real estate would fit into our retirement planning, our tax situation, and our long-term goals. Three years later, we still rely on their advice.”

“Trusted Advisors” – Patricia and John Stevens, Calgary

“We’ve bought and sold eight properties in Canada, but Miami felt overwhelming until we found Miami PB. Their systematic approach and Canadian expertise gave us confidence throughout the entire process.”

Your 2025 Action Plan: Making Canadians Buying Homes in the US a Reality

So here we are. You’ve read about the opportunities, understood the challenges, and learned about the process. The question now is: what’s your next move?

The Market Timing is Genuinely Exceptional

I’ve been in real estate long enough to know that perfect timing is rare, but 2025 is presenting some genuinely exceptional conditions for Canadians buying homes in the US:

Buyer’s Market Conditions:

- 22.6% more inventory than last year (more choices, less competition)

- 94-95% of homes selling at or below asking price (your offers actually get accepted)

- Extended time on market giving you space to make thoughtful decisions

- Motivated sellers willing to negotiate on price and terms

Currency Environment Working in Your Favor: The Canadian dollar has strengthened to 1.3680-1.3719 against the USD in 2025, meaning you’re getting better value than you would have gotten last year. Currency forecasts suggest this favorable environment should continue through 2025-2026.

Interest Rate Trajectory: With rates expected to decline from current levels of 6.6% to approximately 5.7% by year-end, there’s potential for rate improvement during your ownership period, plus refinancing opportunities as rates come down.

Don’t Rush Into This If:

- You need rental income to cover the mortgage from month one

- You don’t have at least 6-12 months of carrying costs in reserves

- You’re uncomfortable with cross-border tax complexity

- You can’t afford to lose the investment without affecting your lifestyle

- You’re looking for quick appreciation or short-term gains

The Miami PB Advantage for Your Success

When Canadians buying homes in the US choose Miami P&B Investments, you’re not just getting real estate agents, you’re getting a complete support system designed specifically for Canadian buyers:

Expertise Built Over a Decade: We’ve facilitated hundreds of Canadian transactions, learning from every success and every challenge. That experience translates into smoother transactions and better outcomes for our clients.

Network of Canadian-Experienced Professionals: From attorneys who understand Canadian legal concepts to property managers who work with Canadian investors, we’ve built relationships with professionals who “get it.”

Ongoing Support Beyond the Transaction: Real estate investment doesn’t end at closing. We provide ongoing market insights, performance monitoring, and strategic advice to help you maximize your investment over time.

Technology and Communication: Advanced client portals, virtual tour capabilities, and digital closing processes eliminate many of the traditional barriers to international real estate investment.

Ready to Take the Next Step?

The opportunity for Canadians buying homes in the US in 2025 is real, substantial, and likely time-sensitive. Market conditions, currency environment, and interest rate trajectory are all aligning in ways that may not repeat.

Schedule Your Complimentary Consultation: We’ll spend time understanding your specific situation, goals, and concerns. No sales pressure, just an honest assessment of whether Miami real estate makes sense for you.

Receive Your Customized Market Analysis: Based on your consultation, we’ll prepare a detailed analysis of opportunities that match your criteria, including current market conditions, financing options, and projected returns.

Develop Your Action Plan: If Miami real estate aligns with your goals, we’ll create a step-by-step action plan customized to your timeline and situation.

Execute With Confidence: When you’re ready to move forward, our complete support system ensures your transaction proceeds smoothly from initial offer to successful closing.

Don’t Let This Opportunity Slip Away

I’ve seen too many Canadians wait for “perfect” conditions that never come, only to watch great opportunities pass them by. The combination of market conditions, currency timing, and interest rate outlook makes 2025 a year you’ll either look back on as the year you made a smart move, or the year you wish you had.

Canadians buying homes in the US successfully in 2025 are those who take action while conditions are favorable. The infrastructure exists, the opportunities are real, and the potential returns are compelling.

Contact Miami PB Investments today to schedule your complimentary consultation. Let’s explore together whether Miami real estate deserves a place in your investment portfolio and lifestyle planning.

Your future self will thank you for at least exploring the possibilities. And who knows? This time next year, you might be the one sending updates from your Miami balcony while your friends are shoveling snow back home.