Miami real estate market continues to shine as a beacon of opportunity for investors in 2025, ranking as the No. 2 top housing market in the country by Realtor.com with a forecasted 24% year-over-year increase in sales and a 9% increase in median sale prices. This impressive growth trajectory makes Miami real estate investing an attractive proposition for both newcomers and seasoned investors alike.

Why Miami Remains a Top Real Estate Market in 2025

As the gateway to Latin America, Miami serves as an international business hub with more than 60 international banks—the second-highest concentration in the U.S. after New York City. This financial infrastructure, coupled with Florida’s tax-friendly environment, creates a powerful foundation for real estate investment growth.

The city’s appeal extends beyond business considerations. With year-round sunny weather, stunning beaches, and vibrant cultural scene, Miami real estate continues to attract domestic migrants from high-tax states and international buyers. According to recent Census data, Miami-Dade County ranks No. 1 in the United States for international migration.

Despite being ranked as the third most expensive city to live in the U.S., Miami’s real estate market shows remarkable resilience. The median home price has risen to $560,000 as of early 2025, representing a 4.7% increase year-over-year. For luxury properties, homes priced at $1 million and above have seen a 3.6% increase in sales compared to the previous year.

What’s particularly noteworthy is Miami’s impressive long-term appreciation rates. Over the past decade, Miami real estate condo prices have skyrocketed by 140.7%, while single-family home prices have surged by 167.3%—significantly outpacing national averages with home equity gains nearly double the national figure.

Types of Real Estate Investments in Miami

Residential Properties

Single Family Homes

Single-family homes remain a cornerstone of Miami real estate investing, particularly in a market where inventory constraints have created a persistent seller’s advantage. According to the Miami Association of Realtors, single-family homes in Miami-Dade County have seen their median prices increase to $655,000 as of February 2025.

Eddie Blanco, Chairman of the Miami Association of Realtors, notes that “within Miami-Dade County, single-family homes remain a seller’s market,” with limited land availability constraining new development. This supply-demand imbalance creates favorable conditions for appreciation and rental income potential.

Condominiums

The condominium market presents a more complex but potentially rewarding investment landscape in 2025. With median prices reaching $455,000 as of February 2025—an 8.3% increase year-over-year—condos offer a more accessible entry point for many investors.

However, the condo market has shifted to favor buyers, with inventory levels reaching 12.6 months of supply. This oversupply is particularly pronounced in the luxury segment, where there’s approximately 33 months of inventory for condos priced at $5 million and above.

Several factors are influencing the Miami real estate condo market in 2025:

- Changing buyer preferences toward smaller, more “cozy” spaces

- New legislation requiring higher HOA fees for inspections and repairs

- Limited financing options, with only 0.9% of South Florida condo buildings approved for FHA loans

Multi-Family Units

Multi-family properties represent a growing opportunity for Miami real estate, particularly as the city continues to experience population growth and housing demand. Investors benefit from diversified income streams, economies of scale, and strong rental demand.

Florida’s Live Local Act provides additional incentives for multi-family investors by offering density bonuses to developers who allocate 40% of units for affordable housing.

Vacation Rentals

Miami’s position as a premier tourist destination makes vacation rentals a compelling investment option. Properties in prime tourist areas like Miami Beach, Downtown, Wynwood, and Coconut Grove can generate substantial rental income, particularly during peak travel seasons.

Key considerations include:

- Location proximity to tourist attractions and beaches

- Property amenities that appeal to travelers

- Understanding of seasonal demand fluctuations

- Awareness of varying regulations across municipalities

Commercial Real Estate

While residential properties often dominate discussions of Miami real estate investing, the commercial sector offers significant opportunities for portfolio diversification.

Retail Spaces: Prime locations in areas like Miami Design District, Brickell, and Wynwood command premium rents and attract luxury brands and innovative retail concepts.

Office Buildings: Miami’s office market has benefited from the migration of financial firms and technology companies from higher-tax states, creating new demand for premium office space.

Mixed-Use Developments: These projects combine residential, commercial, and sometimes hotel components, creating self-contained ecosystems where residents can live, work, shop, and dine.

Industrial Properties: Miami’s strategic position as a gateway to Latin America makes industrial real estate compelling, particularly for logistics and distribution facilities.

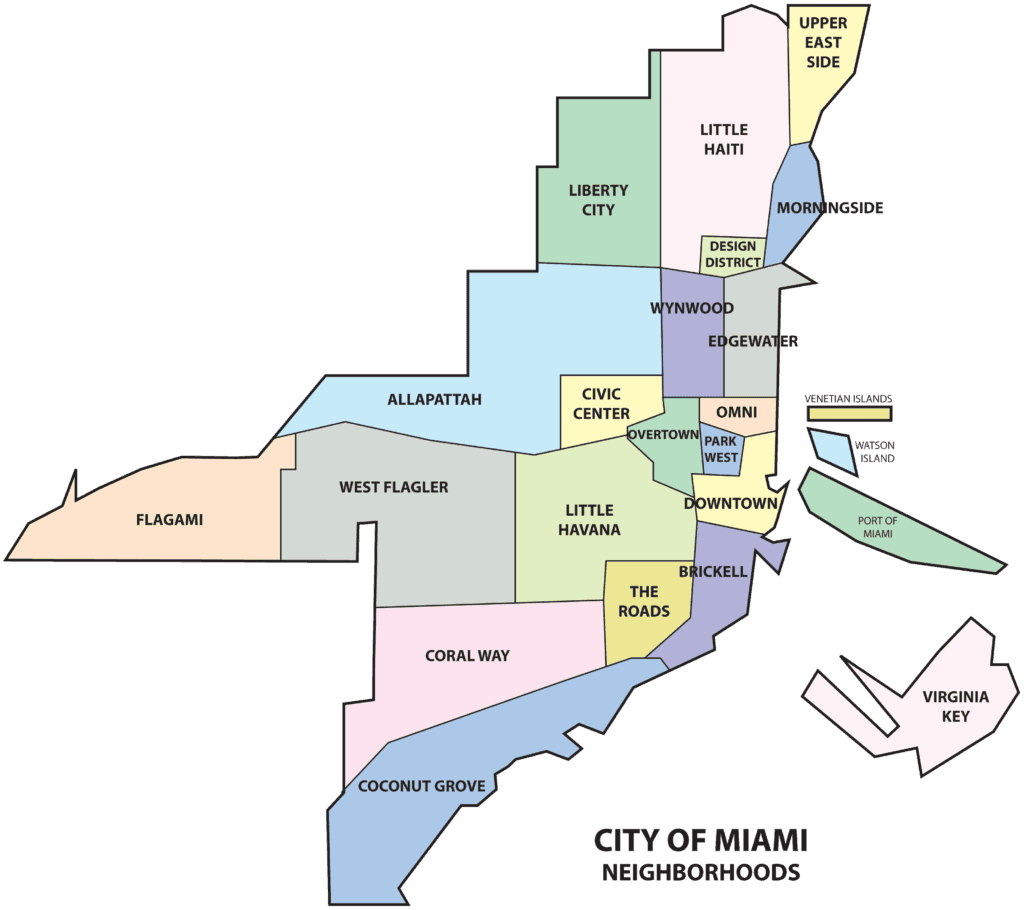

Key Miami Neighborhoods for Investment

Luxury Markets

Miami Beach: Combines stunning waterfront properties, world-class amenities, and an internationally recognized brand. Properties offer strong appreciation potential and excellent rental income opportunities, particularly in the luxury vacation rental segment.

Brickell: Often referred to as the “Manhattan of Miami real estate,” Brickell has evolved into a premier urban luxury destination with high-rise condominiums, mixed-use developments, and premium rental properties catering to young professionals and corporate relocations.

Coconut Grove: Offers a unique blend of luxury, history, and natural beauty with historic single-family homes, luxury waterfront estates, and boutique condominium developments in a village-like atmosphere.

Up-and-Coming Areas

Wynwood: Once an industrial warehouse district, Wynwood has transformed into one of Miami’s most dynamic neighborhoods with adaptive reuse projects, mixed-use developments, and a thriving creative scene.

Edgewater: Situated along Biscayne Bay just north of downtown, Edgewater has emerged as one of Miami’s most rapidly appreciating neighborhoods with luxury high-rise condominiums and value-add opportunities.

Little Haiti: Represents one of Miami’s final frontiers for urban revitalization with relatively accessible prices and proximity to trendy Wynwood and the Design District.

Suburban Investment Opportunities

Doral: Has evolved from a primarily industrial area to one of Miami-Dade County’s most desirable suburban communities with master-planned residential communities, world-class golf courses, and expanding commercial districts.

Kendall: Offers access to Miami’s stable suburban market with diverse property types and price points in an area with excellent schools and comprehensive retail and service infrastructure.

Coral Gables: Known as “The City Beautiful,” Coral Gables offers access to one of Miami’s most prestigious communities with Mediterranean Revival architecture, strict zoning controls, and strong international appeal.

Steps to Getting Started as a Miami Real Estate Investor

Setting Investment Goals and Budget

Before diving into the Miami real estate market, establish clear investment objectives:

- Are you primarily seeking capital appreciation over time?

- Is generating immediate rental income your main priority?

- Are you looking to build a diversified portfolio across multiple property types?

When establishing your budget, consider:

- Down payment requirements (typically 20-25% for investment properties)

- Closing costs (approximately 2-5% of the purchase price)

- Renovation funds if pursuing value-add strategies

- Operating reserves for vacancies, maintenance, and unexpected expenses

- Property management costs if not self-managing

Securing Financing Options

Conventional Mortgage Financing: Investment property loans typically require 20-25% down payment with interest rates generally 0.5-0.75% higher than owner-occupied rates.

Portfolio Loans and Private Banking: For high-net-worth investors, these offer customized loan structures based on overall financial profile rather than rigid conforming loan criteria.

Commercial Financing: For multifamily properties (5+ units) and commercial real estate, loans are based primarily on the property’s income rather than personal income.

Creative Financing Strategies: Consider seller financing, assumable loans, partnership structures, or home equity lines of credit on existing properties of the Miami real estate.

Finding the Right Property

Partner with specialized real estate professionals who understand investment properties and evaluate potential using metrics like:

- Cash-on-cash return

- Capitalization rate

- Gross rent multiplier

- Potential for appreciation

- Value-add opportunities

For Miami real estate specifically, also evaluate flood zone designation, hurricane resilience features, condominium association financial health, and short-term rental regulations if applicable.

Due Diligence Process

Conduct Miami real estate property inspections, verify all financial aspects of the property, and perform a thorough legal and regulatory review. For older condominiums, pay special attention to building recertification status, structural assessment reports, and reserve fund adequacy.

Closing Procedures in Florida

In Florida, closings are typically handled by title companies, real estate attorneys, or escrow agents. Budget for closing costs including title insurance, documentary stamp taxes, recording fees, lender fees, appraisal costs, and prorated property taxes and HOA fees.

Tips for Foreign Investors and Out-of-State Buyers

For Foreign Investors

Legal Considerations: Foreign investors can legally purchase and own real estate in the United States without special visa or residency status, but should work with attorneys specializing in international transactions.

Financing Options: While many foreign investors purchase with cash, financing options include international banking divisions of major U.S. banks, private banks with international operations, and Foreign National loans with down payments typically ranging from 30-50%.

Tax Implications: Understand U.S. income tax on rental income (typically 30% withholding rate unless reduced by tax treaties), capital gains taxes when selling, and potential estate taxes.

Visa Considerations: Property ownership does not grant special immigration status; visa planning should be conducted separately from property acquisition.

For Out-of-State Buyers

Property Management: Professional property management is crucial for out-of-state investors, with companies typically charging 8-12% of gross rent for residential properties.

Building a Local Team: Assemble trusted professionals including a real estate agent, property inspector, contractor, attorney, insurance agent, and accountant familiar with Florida’s market.

Understanding Florida-Specific Regulations: Research homestead exemption rules, hurricane building codes, condominium association regulations, and landlord-tenant laws.

Long-Distance Due Diligence: Use video tours, detailed inspection reports, virtual meetings with association representatives, and neighborhood data sources to overcome geographic distance.

Start Your Miami Real Estate Journey Today

Miami real estate market in 2025 presents exceptional opportunities for both beginners and experienced buyers. The market’s strong fundamentals, combined with its unique position as an international gateway city, create a compelling environment for strategic property investment.

The time to act is now, with interest rates projected to continue their downward trajectory, new construction bringing more inventory to the market, and Miami’s international appeal continuing to strengthen.

Whether you’re ready to make your first Miami real estate property investment or looking to expand an existing portfolio, take these actionable next steps:

- Define your investment strategy

- Establish your budget and financing

- Connect with Miami P&B Investments

- Explore current property listings

- Plan a market visit

Ready to explore Miami real estate investment opportunities? Contact Miami P&B Investments today:

- Visit Miami P&B Investments!

- Call Us!

- Email Us!

Don’t miss the opportunities available in Miami’s dynamic real estate market. Take the first step toward building your investment portfolio in one of America’s most vibrant and resilient real estate markets.